More than 20 000 companies in Poland are required to document their transfer pricing transactions. However, up to 20% of firms in Poland do not have the required documentation, while another 13% rely on documentation prepared by their HQ

Changing legislation and intensified tax audits make this matter more and more important. In the past years tax authorities have most often controlled entities with over 50 M EUR turnover, already 44% of those have encountered at least one TP audit in the past years. The scope and complexity of the documentation are growing, and companies need to pay closer attention to transfer pricing documentation.

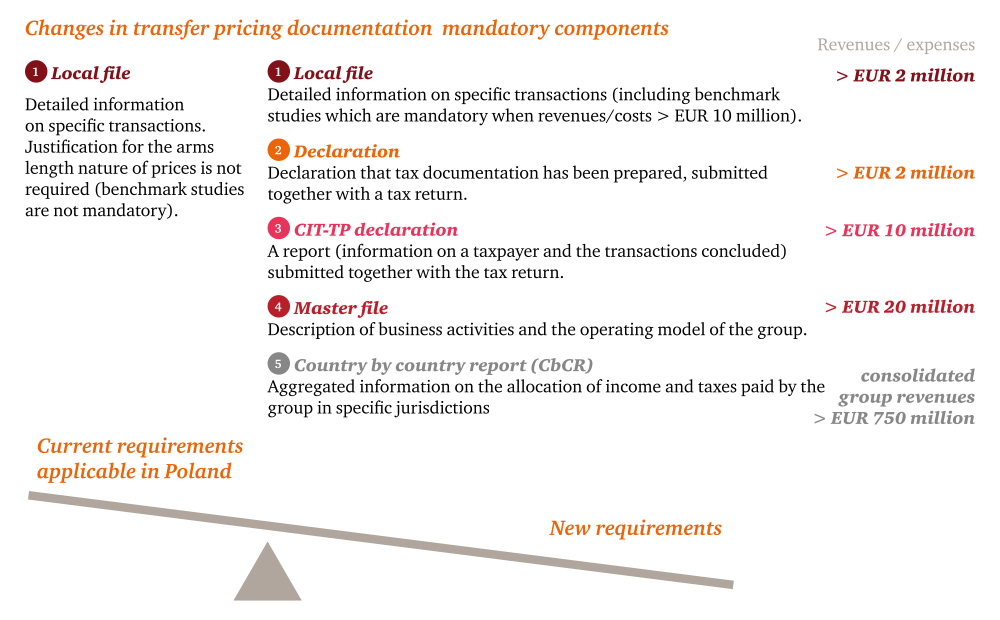

Scope of required TP documentation depends on the level of revenue and/or costs incurred

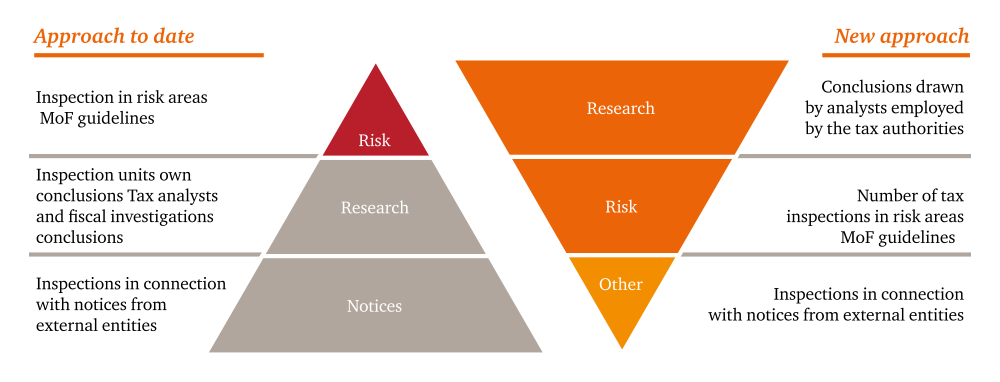

Tax authorities are increasing the number and efficiency of TP audits

How can we support your company?

- APA

- Settlement of costs of intangible services

- Preparation of transfer pricing documentation

1. Long-term loss

2. Profit fluctuation

3. Restructuring

4. Transactions without remuneration (loans and guarantees)

5. 3P vs related - differing results

6. Purchase of management services

7. Licence fees and trademarks

8. Tax havens

9. Frequent changes in TP policy

10. Lack of documentation

TOP 10 most common mistakes in TP

Contact us