{{item.title}}

{{item.text}}

{{item.text}}

Pursuant to Directive No. 2022/2464 of December 14, 2022, on corporate sustainability reporting (the so-called CSRD, Corporate Sustainability Reporting Directive), large entities (meeting the specific criteria listed in the directive regarding number of employees, balance sheet total or net income), will be required to publish annual reports presenting information and indicators documenting their impact on sustainability issues (in the environmental, social and corporate governance areas).

It is worth noting that the intent of the CSRD is not to tick the box exercise, but to stimulate strategic and long term changes in the approach to sustainability that will be consistent with the business. The directive requires executives to analyze sustainability issues such as climate change, biodiversity loss or human rights. It is crucial to link the ESG area to financial opportunities and risks, as well as social and environmental impacts, and to disclose strategies and plans to simultaneously manage sustainability and financial performance.

Sustainability is not only about ensuring compliance with existing and upcoming regulations, but also a driving force and an excellent basis for building the company's value.

Therefore, this area should be one of the key pillars of companies' business strategies contributing directly to their value growth. Boards should move away from a high-level approach to ESG and focus on industry-specific value drivers in this area. Good ESG performance is positively correlated with higher returns on capital and reduced downside risk.

Sustainability has also changed the way deals are done. Only a few years ago, environmental and social aspects were largely the focus of activist stakeholders and forward-thinking regulators only. Today, thanks to the greater maturity of market participants, the ESG area is becoming an integral component of criteria that have significant implications across the entire mergers and acquisitions (M&A) landscape, and when managed well can positively impact a company's value. What's more, as many as 27% of investors are willing to accept a lower return on investment if the company acts in the environmental and social.

This clearly shows why going beyond ESG reporting and risk management as well as improving performance can bring companies higher returns, while increasing company value.

Private equity (PE) firms have been committed to sustainability for years, both in terms of their own ESG transformation and in terms of their portfolio companies.

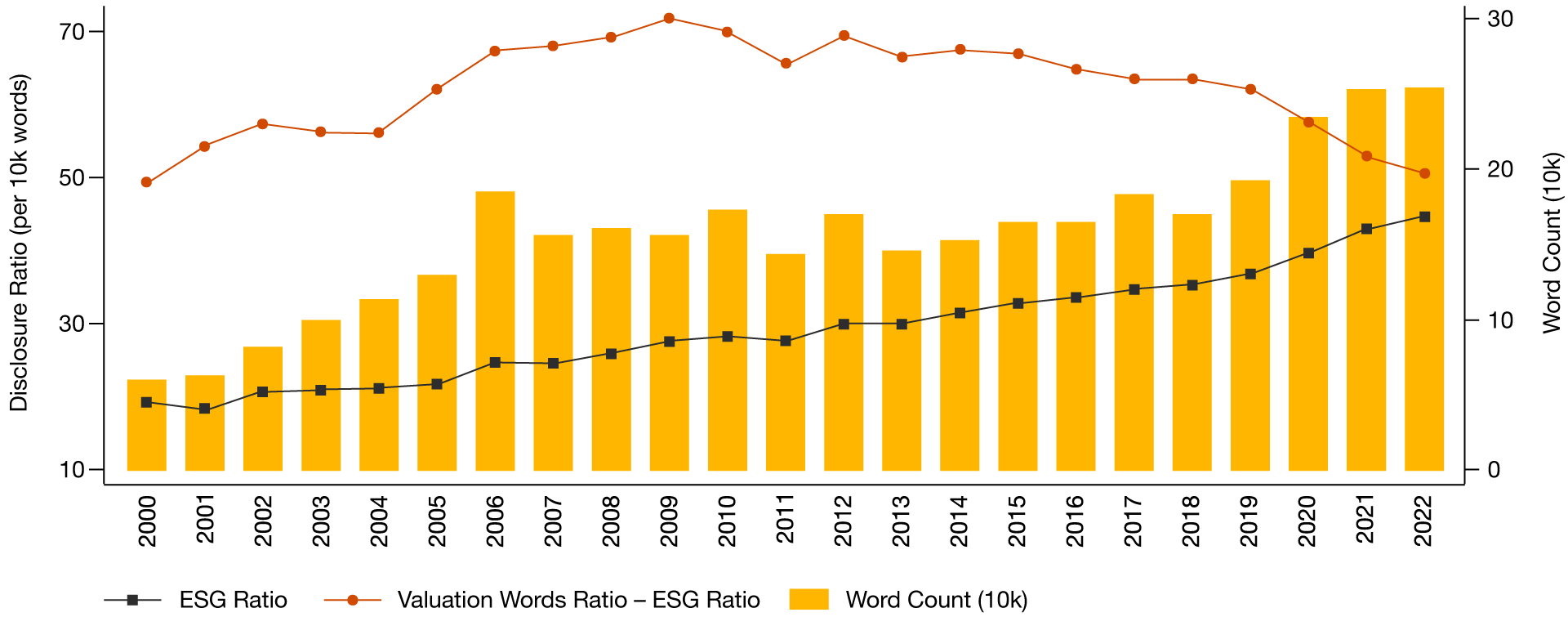

over the past two decades, PE firms have increased their disclosures on ESG issues, regardless of a company's investment strategy, listing status, size, location or industry. To measure the disclosure rate, the number of ESG-related words on the websites of PE firms was used and it was found that the use of these words increased by 200% between 2000 and 2020.

The increase in ESG disclosures was associated with a 4.9% increase in a company's net IRR (internal rate of return).

[source: ESG Disclosures in the Private Equity Industry, TRR 266 Accounting for Transparency Working Paper Series No. 132]

PE firms with portfolio companies based in countries where mandatory ESG disclosure by public companies has been implemented were associated with increased ESG disclosure. For example, a 10-point increase in a company's investment in portfolio companies in countries where mandatory reporting was implemented was associated with a 2.3%increase in the number of environmental disclosures made by PE firms.

Another factor contributing to the increased ESG disclosures is the growing network of PE firms and other investors that have committed to the United Nations Principles for Responsible Investment (UN PRI), which seek to integrate ESG and responsible investment principles into investment and ownership decisions. PE firms that have committed to UN PRI standards have increased their ESG disclosures by about 30%.

The figure below shows the evolution of PE firms' ESG disclosures on their websites between 2000 and 2022.

The number of ESG disclosures by PE firms has increased significantly over the past two decades. The study shows that these disclosures respond to investor demand for sustainable investment opportunities.

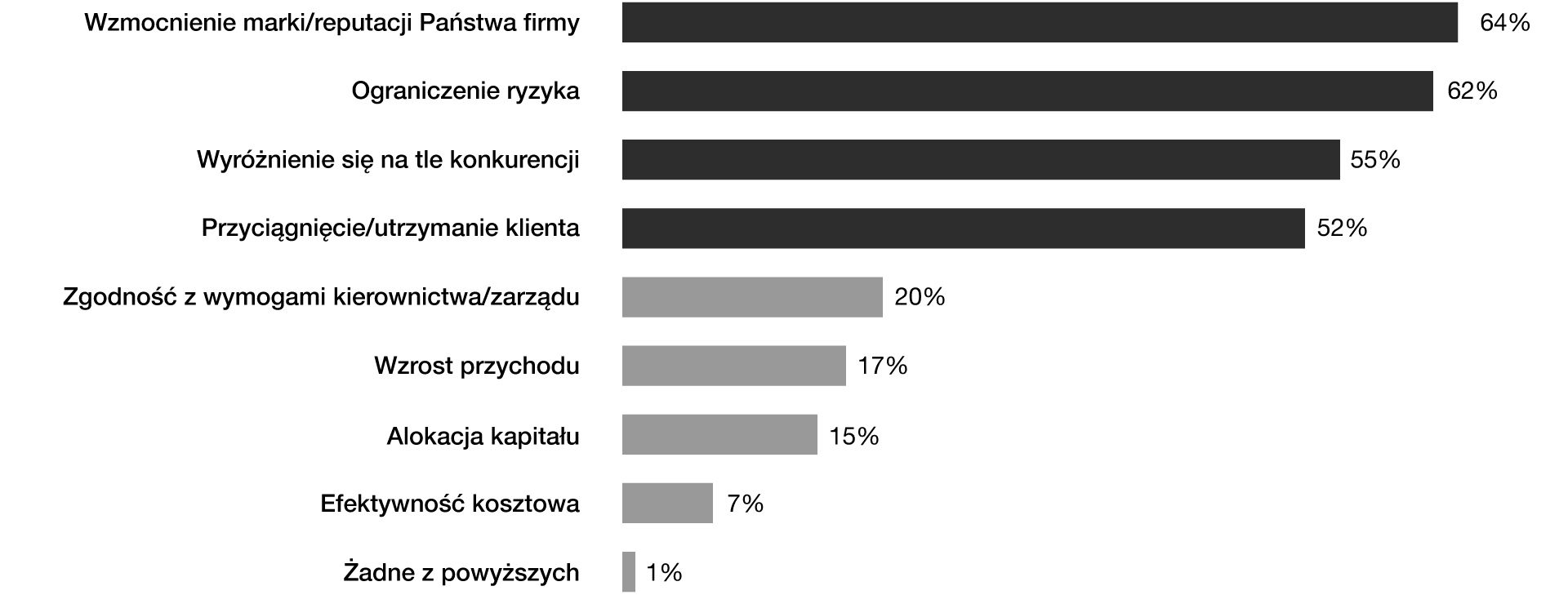

Ten years ago, PwC first surveyed private equity firms on their approach to ESG issues. At that time, the main issue identified was risk management. Over time, perceptions of sustainability have changed significantly. The latest 2023 survey, which included more than 150 PE firms, shows that respondents overwhelmingly believe that managing the ESG area can help create value.

respondents say this was the case in more than half of their transactions. Nearly 50% of respondents indicate that ESG aspects were a major factor in value creation in at least some deals.

respondents ranked value creation among the three most important factors influencing their organization's ESG activities. This result was similar to 66% recorder in 2020.

of this year's respondents consider value creation to be the main driver for taking ESG actions - a much higher result than in 2020 when it was 29%.

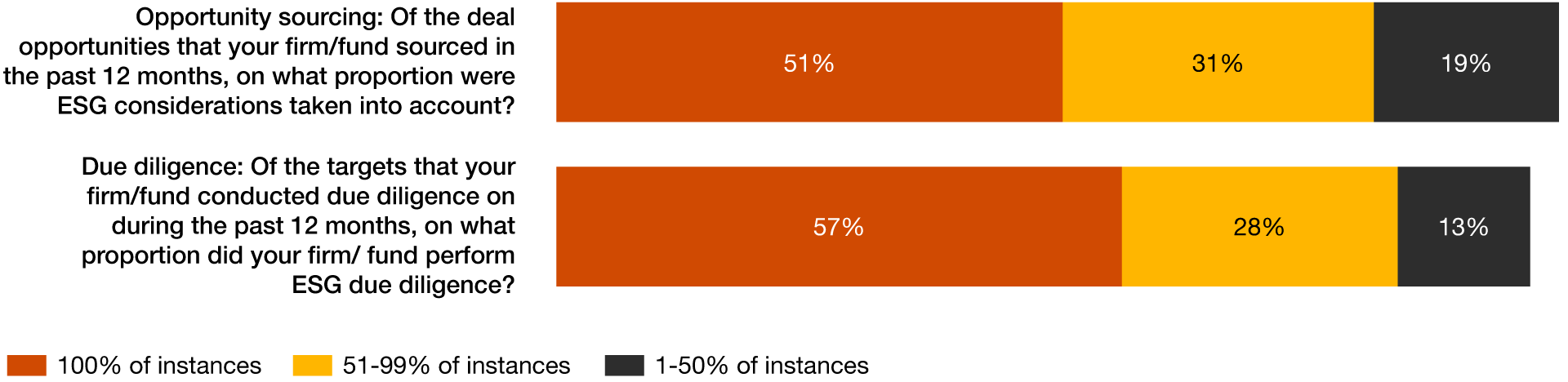

The survey results indicate that it is standard practice for PE firms to consider ESG factors when conducting due diligence, creating post-acquisition action plans and deciding on deal terms.

Value creation is now the main driver of ESG activity in private equity. In addition, the importance of regulations and the impact on exit value has increased since our last survey in 2022.

More than half of the respondents say that managing ESG topics has four main opportunity-generating advantages - in our experience, all of them can be linked to value creation.

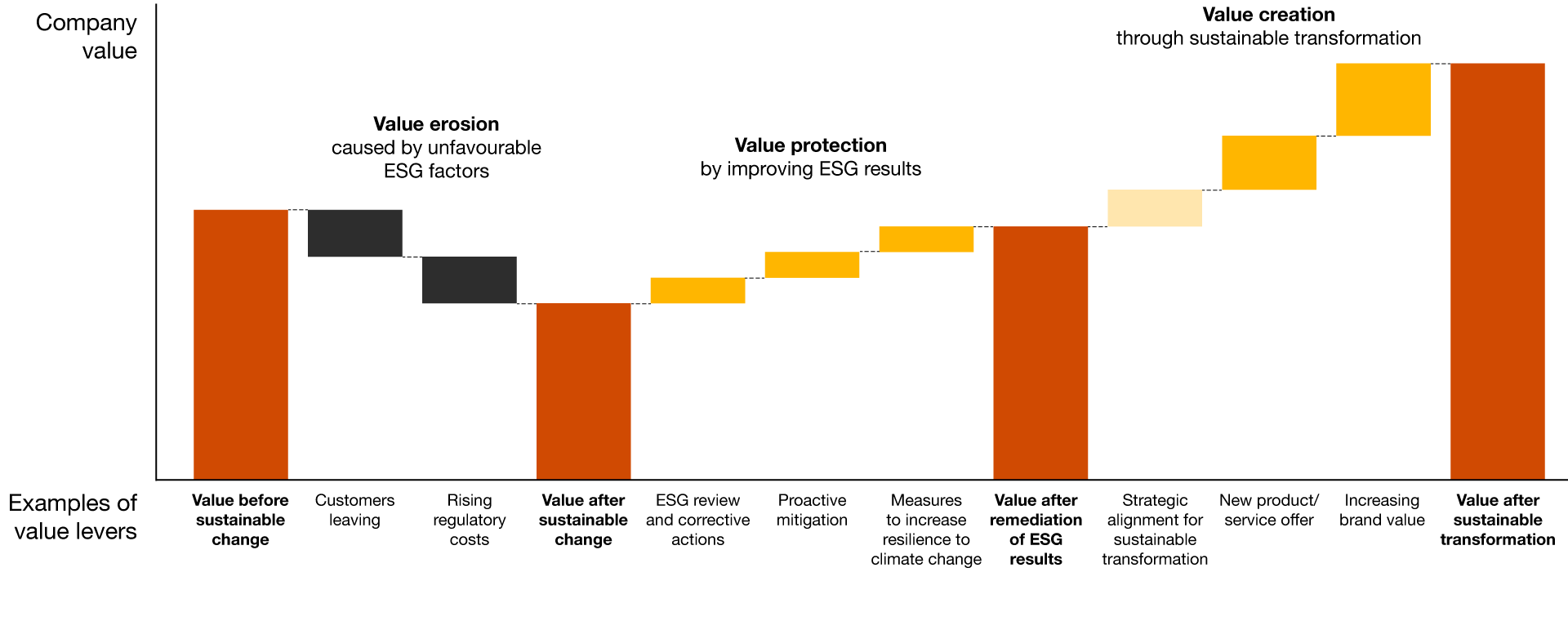

With this in mind, it is worth looking at PwC's Sustainable Value Creation Bridge, which is an unique approach to value creation through sustainable transformation. The model quantitatively defines the loss of value associated with inaction in the ESG area, identifies actions to protect value, and describes an approach to developing a strategy for value creation through sustainable transformation. It is clear at a glance that inaction in the ESG area inevitably leads to loss of value, especially with the simultaneous progress in the ESG area of industry competitors, changing expectations of consumers, employees and investors, as well as new regulations.

ESG practices are becoming more and more prominent, with enough interest among PE firms that they can already be considered industry standards. These practices are being implemented at the opening and closing stages of the deal lifecycle. More than half of respondents say they have taken ESG factors into account when sourcing deals and conducting due diligence reviews in the past 12 months, as shown in the chart below.

The survey shows that PE firms ESG topics in post-acquisition plans for new portfolio companies are very often included. Based on our experience, we know that the work done before and during due diligence, in line with companies' ESG commitments, is typically the ideal basis for activities included in post-acquisition sustainability plans.

The percentage of respondents who say their companies systematically or ad hoc incorporate ESG-related risk and opportunity analysis into their transformation plans has increased. In this year's survey, the share exceeded 90%, which is an increase of 17% compared to 2020.

How does this look like in practice then? Can ESG aspects be a reason why a deal is not closed? The survey shows that PE firms often abandon deals because of ESG factors. This is perfectly illustrated in the chart below, which shows the percentage of respondents claiming that at least one deal has changed in the last 12 months due to ESG factors.

To assess the importance of ESG topics, our 2023 survey of PE firms also asked respondents about the extent to which their organization considers ESG topics to be important, based on a list of 21 such topics, and takes steps to manage them. Across all the categories analyzed, i.e. environmental, social and governance, several notable patterns and findings also emerge.

Building a company's value through ESG aims to achieve sustainable success that considers both financial and intangible factors. How?

An ESG approach to management can influence the creation of company value by improving operational efficiency, reputation, innovation, risk management and access to capital. ESG-compliant activities contribute to the creation of sustainable and balanced value that considers both financial and intangible aspects.

Initiatives to build employee competence and increase employee engagement.

Actions to increase trust and commitment from customers who value sustainable solutions.

Actions to reduce energy consumption to reduce operating costs (including replacing traditional lighting with LEDs in stores and backrooms, reducing lighting intensity in selected hypermarkets by 10-15%, increasing the number of motion sensors in restrooms and locker rooms, increasing control over the operation of refrigeration and air conditioning equipment).

Sources:

{{item.text}}

{{item.text}}

Agnieszka Rogowiec