-

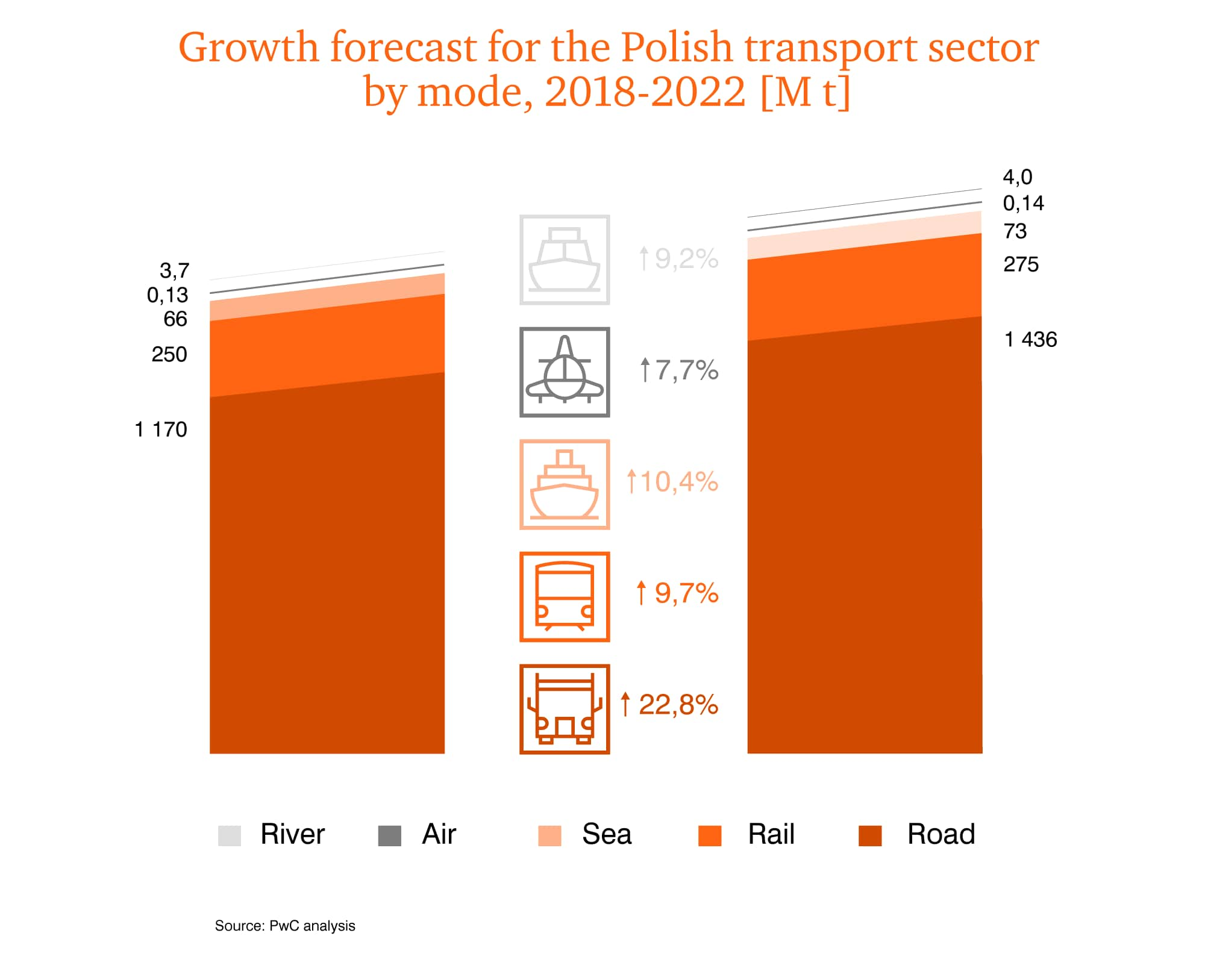

22,8%

projected total increase in volume (tonnage) handled by Polish carriers in the years 2018-2022

-

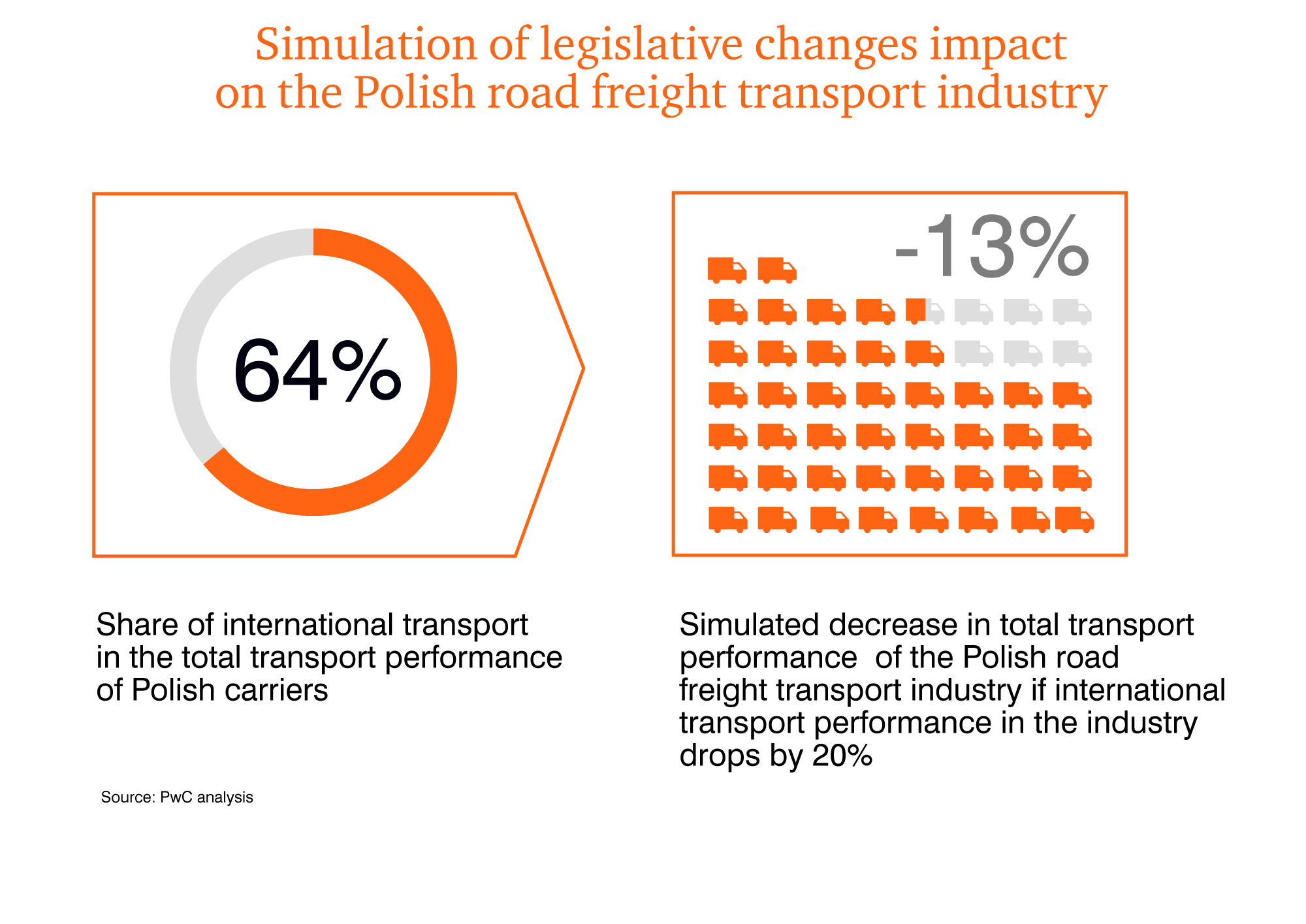

64%

share of international transport in the total transport performance of Polish carriers

-

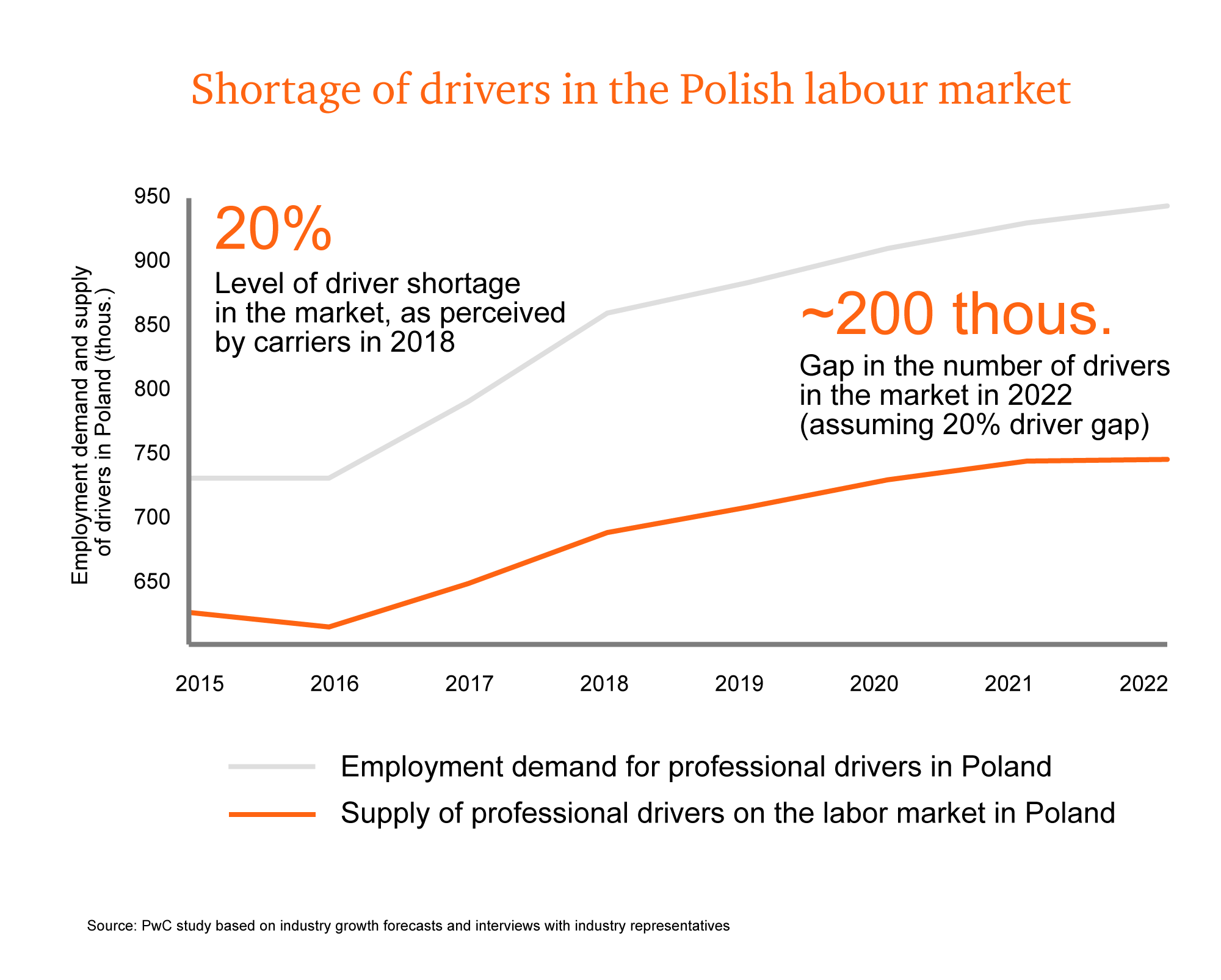

200k

estimated shortage of drivers in 2022, with a current supply gap remaining constant

-

28%

potential for operating costs reduction due to development of autonomous vehicles after 2025

The road transport market is currently witnessing changes on an unprecedented scale.

The dynamic surge in tonnage and transport performance (ton-kilometers) still continues, and leads to growing shortage of drivers in the labor market. Furthermore, Polish carriers must prepare to face further legal and technological challenges. Given the diversity of the anticipated changes, this report carefully groups and structures the various dimensions of them.

Additionally, in our study we analyzed the trends that will shape the market in the years 2020 - 2030. Our forecasts were enriched with the forecast of market development in the period of 5 years - from 2018 to 2022.

Analysis of the Polish road transport sector presented in our report led to identification of five key forces that will shape the segment in Poland in the forthcoming years.

5 forces that shape the development of road transport in Poland:

Increase in domestic, import and export transport services

- In the period 2018-2022, the Polish road transport sector can be expected to see a total increase in volume of almost 23% (in terms of tonnage of transported goods).

- The Polish road transport sector is currently at the peak of its growth phase. It is estimated that the tonnage it handles will increase from approx. 1.17 billion tons in 2018 to approx. 1.44 billion tons in 2022, with an average annual increase of 5.3%.

- In the opinion of industry representatives, the factors presented in this report will, by the end of 2020, lead to an increase in industry costs of 7-15% as compared to 2018.

- In the near future, a significant shift in demand towards domestic services (and a smaller one towards less-than-truckload [LTL] services) can be expected.

Reorganization of international transport due to changes in EU law

At the level of the EU-28, fundamental changes to road transport regulations are planned, including the provisions of the "Mobility Package" and changes to the legislation on coordinating social security systems and other social regulations. These changes will certainly trigger the following effects in the industry:

- Increased costs of transport networks (due to reduced efficiency) and increased labor costs.

- Decreased revenues related to restricted access to the market in the scope of cross-trade and cabotage services and, consequently, also of import and export of goods.

- The shifting of Polish carriers’ services from EU markets to the Polish market.

- Increased risk and barriers to doing business, especially for small carriers due to increased complexity of regulations.

- Forced internationalization of carriers which today operate on many foreign markets from the territory of Poland.

- Increased concentration as a result of bankruptcy of small enterprises which do not have appropriate shares of transport in Poland and on foreign markets in their operations.

Driver shortages

The existing shortage of drivers with desired skills is very likely to grow to the level of nearly 200,000 drivers (20% of labor demand) in 2022.

- In 2015, the shortfall was estimated at around 100-110,000 drivers, i.e. more than 15% of the total supply, estimated at 600,000-650,000, as compared to the demand, estimated at nearly 730,000 drivers.

- The industry representatives we interviewed reported that, in their estimation, at the end of 2018 this gap reached 20% of demand (in qualitative terms, i.e. the shortage of workers with sufficient skills).

- Keeping the projected market growth intact and assuming that the gap remains close to the current 20%, the total shortage of drivers in the industry is expected to reach nearly 200,000 in 2022, with demand at around 950,000.

The insufficient number of drivers will also lead to increased payroll costs in the industry and, as a result, may lead to higher freight rates. Implementation of autonomous vehicles will not offset this shortage in the short term.

Digitalization

Digitalization of transport in Poland is progressing in four areas:

- Basic digitalization - including measures currently underway: IT implementation of processes, automation of administrative services, optimization of transport networks thanks to the use of geographic network modeling solutions.

- Market platformization - ongoing development of digital platforms for ordering online services from a large base of service providers.

- Digital giants - ongoing entry into the transport and logistics market by large companies that have emerged due to digital technologies, such as Amazon, Uber, Asos, Ocado (and many others).

- Advanced digital technologies - intensification of advanced solutions entering the market in the area of telematics, artificial intelligence and blockchain-based solutions, expected after 2022. Currently these are still in the test phase.

Implementation of digitalization solutions will be crucial for reducing operating costs, adapting services to changing customer needs and implementing solutions with high added value. In the short term, however, they will be available to large carriers who will have the capacity to implement them, which may create an additional barrier for smaller businesses and increase market concentration.

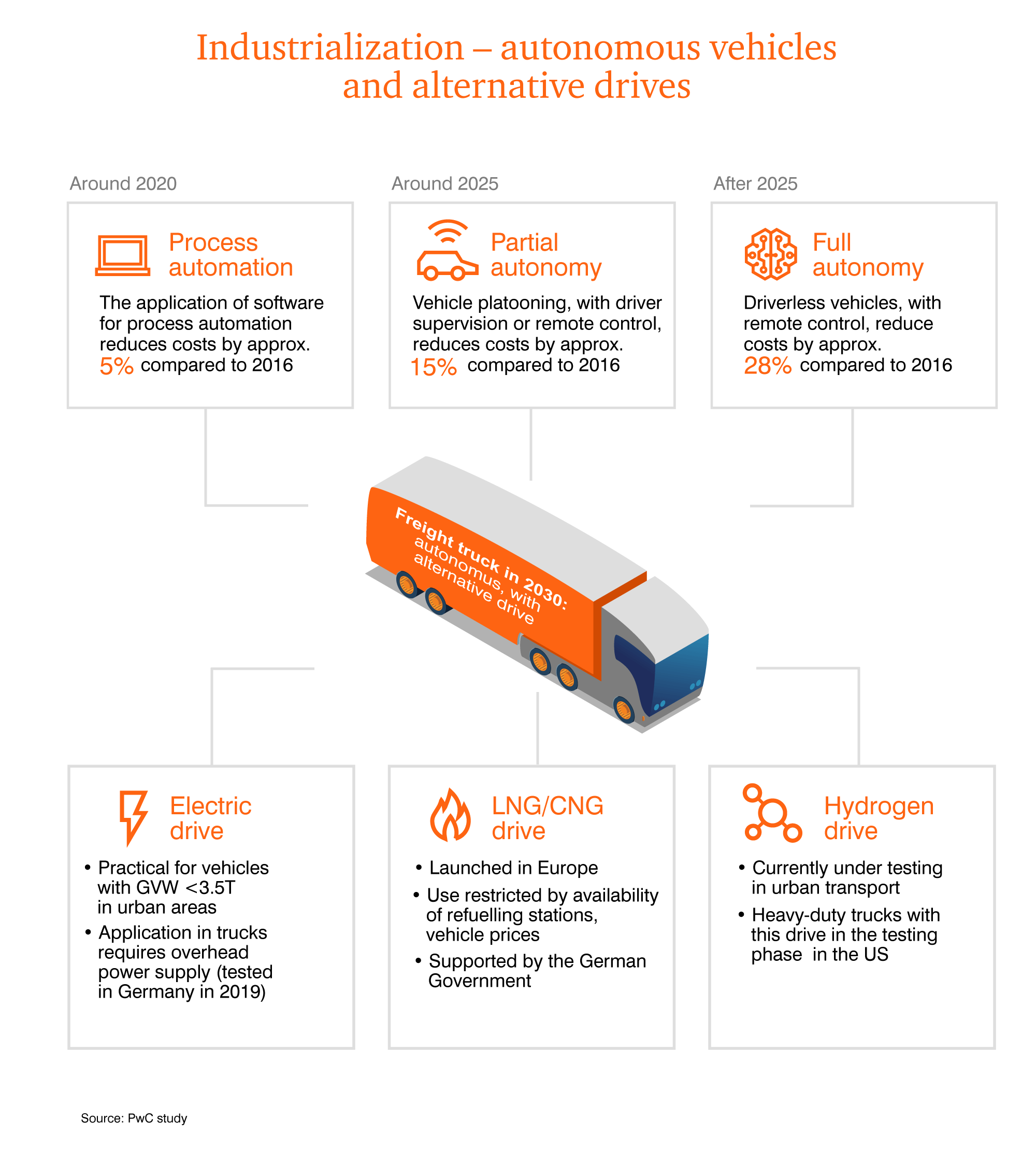

Industrialization

The transition from a traditional to an industrialized transport industry will be driven by following technological trends:

- Autonomous vehicles - This will enable operating costs to be reduced by about 15% by 2025 due to a reduction in labor costs, and potentially even to a level that is about 28% lower around 2030 (as compared to 2016). It will also reduce the demand for drivers and increase the demand for autonomous system specialists (including programming, configuration, maintenance, day-to-day supervision).

- Alternative drives - This will adapt the industry to growing CO2 emissions requirements and enable transport costs to be reduced in the long term, but this impact will not be seen until 2025 at the earliest. In the short term, the diesel engine will keep being the standard, as it currently dominates the industry. In last-mile transport, including in urban areas, faster popularization of electric and CNG vehicles can be expected, and on long journeys LNG-powered vehicles can be expected to become more popular faster. The hydrogen propulsion system in road freight in Europe currently remains in the testing phase.

The development of new technologies requires great investment, so solutions in the area of autonomy and new drives will be more easily accessible to large carriers with higher investment capacity, which may be a factor increasing the level of concentration in the industry.

Contact us

© 2015 - 2026 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.