One-fifth of finance functions have the potential to effectively support the implementation of the business strategy in the perspective of the next 3-5 years

The results of the study clearly indicate that the finance transformation process poses a challenge for many CFOs. The traditional role of the Chief Financial Officer still requires a significant investment of time and commitment, leaving little room for development towards supporting strategy implementation and delivering added value to the business.

The process of technological transformation in finance is already underway, but research results suggest that the pace of change is too slow, mainly due to the lack of maintaining the appropriate sequence in the priorities of transformation projects, including strategy and processes. In the face of the evolving role of finance and growing expectations, entirely new skills and tools are needed, such as the Enterprise Performance Management solutions. Soft skills, including leadership and managerial competencies, also gain significance. Motivation and talent development programs are crucial to enable the team to effectively support the business, improve process efficiency, and smoothly navigate through changes.

There is no one right path for finance transformation. It is important to be open to best practices and understand the strengths and weaknesses of your organization to fully leverage its capabilities.

This report serves as a kind of checklist that each of you can use for your own needs to check which elements of the finance transformation path should still be supplemented or redesigned.

Dorota Jamiołkowska

Director at PwC Poland, leader in controlling advisory

Development strategy for finance - a key component on the path to maturity

The survey results indicate that as many as 34% of respondents do not have an adopted finance development strategy at all, and an additional 12% are only in the process of preparing it. A similar situation arises concerning IT strategy or cloud strategy. Interestingly, companies without a clear strategy often encounter numerous challenges on the path of finance transformation – as acknowledged by 44% of surveyed CFOs.

Any chance of changing the current state?

Work on the strategy should start with diagnosing the current state and understanding needs, identifying problems and developmental barriers, and then defining priorities. The strategy does not have to be an extensive document; a few points translated into measurable indicators will suffice, guiding the direction of actions. Companies with mature financial functions not only have a developed strategy but also employ a structured approach to its implementation, utilizing IT tools to monitor the realization of transformational value based on predefined goals and indicators.

Comprehensive definition of financial processes remains a challenge

Understanding the processes executed by finance teams is a fundamental component of building a mature finance function model. CFOs often express that their processes are dispersed: finance is responsible for non-financial processes, and vice versa — business is significantly involved in financial processes. Our research confirms this, as only 40% of CFOs have comprehensively defined financial processes.

Any chance of changing the current state?

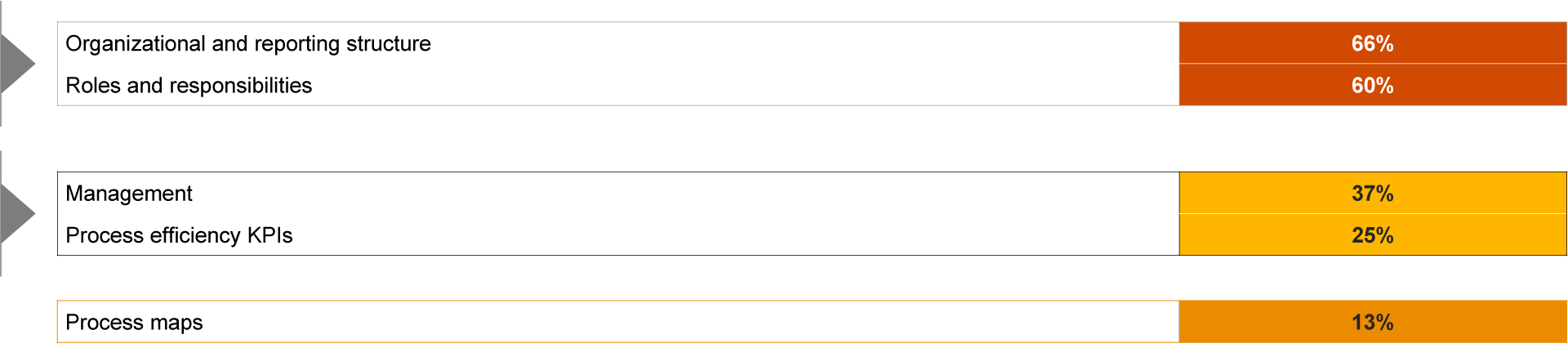

The first crucial step is to structure processes: conduct an inventory and record financial processes. Survey results indicate that while two-thirds of respondents have a defined organizational structure and specified roles and responsibilities, an equal proportion seems to neglect either process management or defining and monitoring efficiency indicators.

Due to proper management, for instance, through the establishment of a suitable meeting schedule, we are capable of ensuring efficient communication and collaboration among individuals or teams involved in a specific process. This not only enhances productivity but also diminishes tension among participants in the process. Additionally, meticulously selected Key Performance Indicators (KPIs) assist us in scrutinizing processes for potential enhancements and the formulation of increased efficiency.

The most overlooked element is the process maps. They illustrate the quality of processes. Process maps serve as the foundation for process optimization: standardization, automation, elimination of unnecessary actions. Without them, subsequent steps towards maturity are significantly impeded.

Q: Which of the following components have you implemented as part of financial processes?

Automation of accounting and tax processes remains high on the CFO's priority list

The study shows that there is still significant potential for process automation: 30% of respondents have automated processes to a considerable extent. What does this mean? With a significant level of automation, a larger part of the process is performed automatically, but employee intervention is still required. In the case of full automation, manual work is eliminated, and the role of the employee is limited to monitoring and responding to deviations or exceptions.

Any chances of changing the current state?

Accounting and tax processes should be automated as quickly as possible to deliver value to the business.

The study shows that CFOs would like to automate accounting and tax processes as a priority. This confirms that companies want to be better prepared for upcoming challenges and focus on tasks supporting business analysis and insights generation, as well as planning and budgeting. Automation is just one of the accelerators of change.

Q: Which processes would you like to automate in the first place?

The use of technology is gaining momentum, but the potential is still not fully utilized

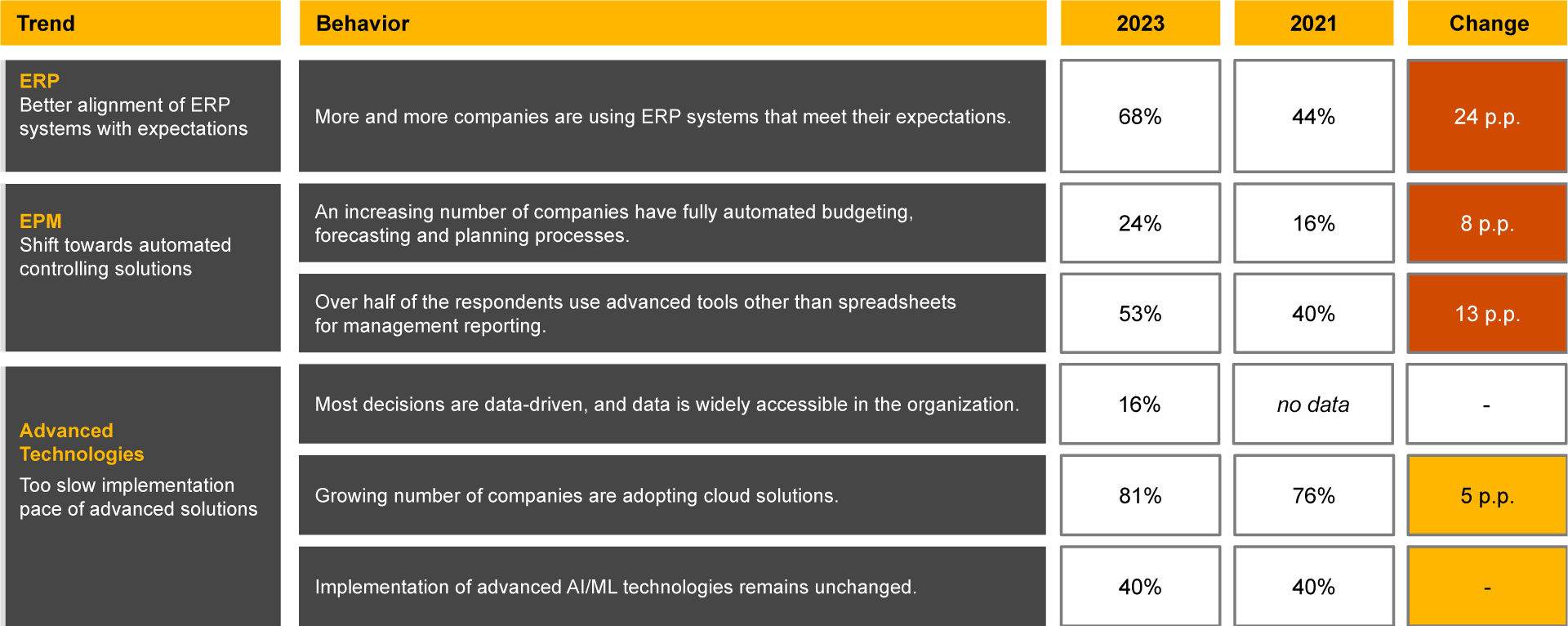

An inherent aspect on the path to finance maturity is technology. Among the surveyed, we observe an increase in technology utilization. More and more companies (68% of respondents in 2023) ensure the proper adaptation of ERP system functionalities to meet CFO needs.

The needs of the finance function are constantly growing, and current systems will soon cease to be effective support. Therefore, finance teams should remember about regular updates (cloud comes to our aid here, and another solution is the use of supporting technologies, e.g. EPM - Enterprise Performance Management solutions).

Despite the visible trend of moving away from spreadsheet use in financial processes, still, 47% of CFOs rely on these tools for managerial reporting.

Any chances of changing the current state?

Close to one-fourth of surveyed CFOs already see the potential for automating financial planning processes and the benefits currently offered by EPM-type technological solution providers. An increasing number of companies have fully automated budgeting, forecasting, and planning processes (24% in 2023 vs. 16% in 2021).

Availability of data in the organization is the driving force behind changes in the world of finance, which is why a good practice among leading companies is data democratization, i.e. ensuring real-time access to current information for employees at every managerial level.

Improving the decision-making process is one of the values of digital transformation, as indicated by leaders in the latest PwC study, "Cloud. Leaders see value."

The use of cloud solutions is also gaining momentum. Already, 81% of CFOs declare that they use cloud solutions, although one-third of those surveyed do not have a comprehensive cloud transformation strategy.

I am only as strong as my team

People are a key factor in the process of successful transformation, and the finance function in a company is as strong as the team that forms it – strong in skills, commitment, and the level of understanding of the business it supports.

However, expectations and desires are one thing, and the actual ability of the CFO and their team to face challenges and the level of engagement is another. In Polish companies, the level of engagement in the finance departments is low (14%), significantly lower compared to the global average (23%) – according to research by Gallup Institute® (Gallup, Inc., "State of the Global Workplace: 2023 Report"). In this context, the ability to motivate employees, build their capacity for engagement, as well as identify talents and support their development, becomes crucial in the transformation process.

Any chances of changing the current state?

Transformation requires wise and conscious leaders who take care of themselves and their emotions. Only then will they be able to create an engaged team, resilient to unexpected turns, and supportive of the transformation. A conscious and effective leader should utilize the support available in their daily work through change management methods, like communication, building engagement, ensuring proper dialogue between stakeholder groups, or upskilling. As the study shows, 12% of companies have a talent development program dedicated to employees in finance teams, which is a good result considering the data from 2021, when this result was 7%.

Finance Transformation Roadmap

When planning a transformation, we must adopt a comprehensive approach to change and development in the areas of strategy, organization, processes, people, and technology. We won't achieve organizational maturity by focusing only on selected elements. At the same time, remember that individual stages of development are designed to prepare for the next ones. It is essential to properly structure and plan the next steps, meaning to develop a roadmap for our transformation.

In times of continuous change and uncertainty, the finance function must react quickly and flexibly adapt to new conditions and expectations. Can the development process of the finance function be accelerated in such circumstances? Is there a shortcut that allows keeping up with dynamic market changes? Thanks to technology-supporting solutions, we can bypass some steps, such as required ERP system updates, and the use of AI/ML that does not require the implementation of Data Lake or Big Data will accelerate and automate some tasks. However, not all actions can be skipped - in the case of AI solutions, for example, data organization is still necessary.

The shortcut approach requires an innovative mindset and the right way of thinking. When opting for such a solution, it's worth first checking what works, identifying gaps, and only then deciding what to implement. Such a transformation should be well-planned, aligned with the finance area's strategy, and preceded by a precise situation diagnosis. Before taking specific actions, let's ask ourselves - is the shortcut approach suitable for me?

Magdalena Niemczyk

Senior Manager at PwC Poland, Finance Transformation

What priorities are adopted at different stages of development?

About the survey

The survey was conducted in collaboration with AICPA & CIMA from July to October 2023, sampling over 30 companies in Poland from more than 10 industries. Average revenue amount: PLN 1,577 million, employment: 1,700.

The CFO Compass Survey is conducted among Chief Financial Officers and was initiated as part of the CFO Compass platform operating in PwC Poland. The survey is aimed at CFOs who want to assess the readiness of the finance function to effectively support the implementation of business strategy.

Report from the CFO Compass Survey 2023

Subscribe to PwC email updates

Contact us