360° PSP AML Services

The changing regulatory landscape for money laundering and terrorist financing affects payment service providers, end users and cooperating financial institutions. This regulatory evolution challenges existing operating models, but also presents an opportunity to accelerate organisational changes and adjust Financial Crime compliance to the new reality. To continue to manage Financial Crime risks and processes during these changes,we offer a holistic, tailor-made and experience-driven approach. Let's work together to create a solution for your business.

Solutions Benefits Testimonials ContactOur proven solutions

360° AML Compliance for PSP

360° AML Compliance for Banks

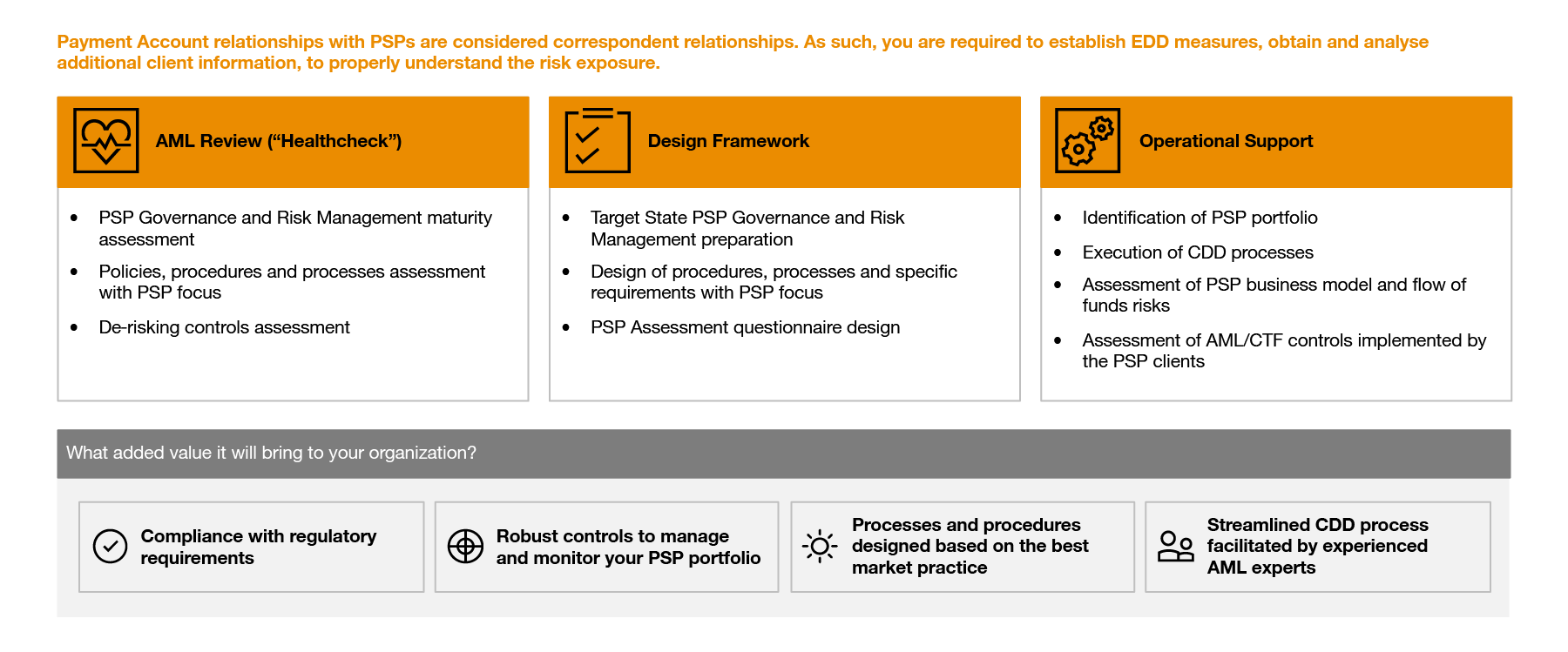

Our approach is designed to provide PSP with an impartial top-down overview of the current state of institution-wide AML Programme and its alignment to your Agent’s AML Programme to ensure efficiency and effectiveness in cooperation.

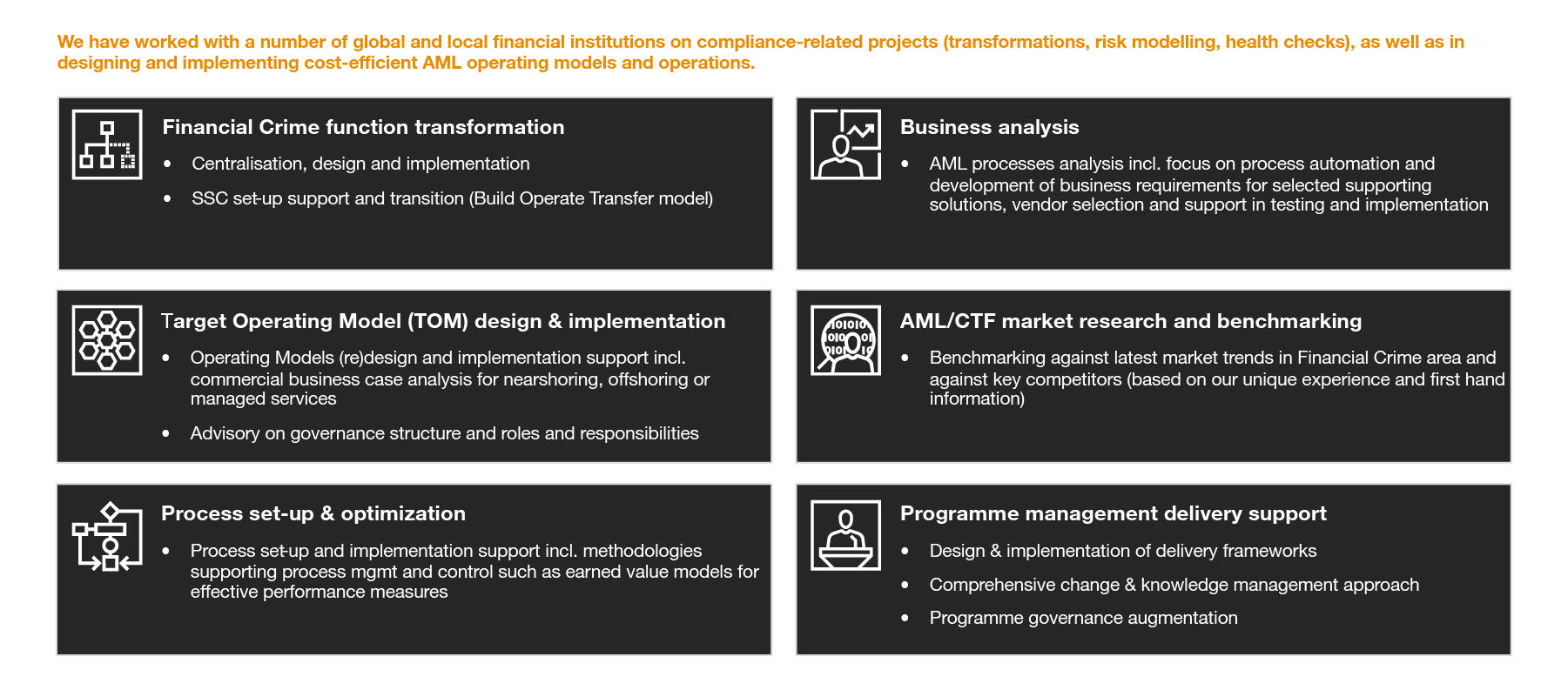

We support the transformation of our clients' organizations by advising on regulatory compliance & its effective operationalisation. Our AML knowledge paired with the process design expertise allows us to deliver best in class, tailored solutions

The purpose of AML risk rating model is to assess and define the level of AML risk associated with merchant based on its characteristics, products utilized and transactions performed

External compliance experts can support number of compliance function activities in your business and ensure cost-effectiveness and on time delivery of the key areas.

Operational delivery based on one robust technology platform to seamlessly execute, simplify & enhance day-to-day processes

We can support your Transaction Monitoring efforts by providing expert support in establishing a robust environment allowing full transparency and understanding 3rd party flows of funds

To cater for specific characteristics of Payment Service Providers application of tailor-made AML risk model capturing all relevant information and risks will allow you to properly assess non-typical risks of this emerging industry

We can support you to redesign your approach and establish the Target Operating Model to accommodate robust regulatory requirements applicable to your PSP Portfolio

Our experts can support your CDD processes for PSP clients - from the requirements and process design to execution. We bring vast regulatory and operational experience that can increase your risk coverage and management

We can support your Transaction Monitoring efforts by providing expert support in establishing a robust environment allowing full transparency and understanding 3rd party flows of funds

One technology platform to simplify your day-to-day operations

We support the transformation of our clients' organizations by advising in regulatory, operational strategy and project management areas.

Key benefits of AML PSP Services

- Holistic approach to AML compliance provided by cross functional teams

- Flexible solutions tailored to your needs

- Knowledge matched with experience to create best outcomes

- Cutting-edge approach to form the future

- Highly configurable technology solutions to facilitate your processes

- Understanding of and experience with different regulatory regimes

How do we help our clients

-

The Biggest European fintech unicorn operating globally

Project

Preparation of Procedures and Training curriculum in the area of AML/CTF for the Biggest European fintech unicorn operating globally.

Context

A client preparing for a global expansion requested the review of its AML/CTF Policies and Procedures, uplift of those, as well as training sessions delivery.

PwC approach

PwC conducted the review of AML/CFT Policies and Procedures, as well as factual current state through the interviews with Process Owners. Furthermore, in cooperation with client stakeholder, robust Procedures for KYC Process and Transaction Monitoring were created. In course of the project, Training curriculum, including training plan and training materials were also created. In addition to that, PwC delivered a list of observation and proposed recommendations In addition, PwC prepared a list of observations and proposed recommendations aimed at improvement of the AML/CTF processes, as well as supported the implementation of KYC Periodic Review process.

-

One of European fastest growing payment service providers

Project

Preparation of KYC Working Instructions and operational support for KYC Periodic Review for one of European fastest growing payment service providers.

Context

A European PSP requested support in preparation of KYC Working Instructions, training sessions delivery for new hires, as well as operation support, to support the growth of its operational teams.

PwC approach

In the course of the project, PwC assisted in defining the needs of the client’s operational teams, in the context of designing KYC Working Instructions, training new hires, as well as the knowledge management process. In close collaboration with client’s Compliance, Operations and Process Architects, we created a design of the Knowledge Management infrastructure and Induction plan for new hires (tested on the two groups). Additionally, operational support during the KYC Periodic Review process supported PSP’s efforts to reduce the backlog in this area.

-

Leading Dutch omni-channel payment solution provider

Project

Preparation of KYC Procedures, approach to Enterprise Wide Risk Management and operational support for a Leading Dutch omni-channel payment solution provider.

Context

The Client as a part of its efforts to remediate its AML/CTF and Risk Management Programme requested support in preparation of KYC Procedures, Enterprise Wide Risk Management, operational support assisted by the technology solutions.

PwC approach

PwC worked on a comprehensive set up of AML remediation programme from KYC Procedure and Risk framework design through implementation of robust technology and automations to setting up additional capacity for operational delivery amounting to over 50 FTE. PwC cooperated with Product Owners, Sales, Compliance, Operations, Finance, Credit risk and IT, to deliver a structured and robust approach to timely review of client’s merchant portfolio.

Credentials

Context

A client preparing for a global expansion requested the review of its AML/CTF Policies and Procedures, uplift of those, as well as training sessions delivery.

PwC approach

PwC conducted the review of AML/CFT Policies and Procedures, as well as factual current state through the interviews with Process Owners. Furthermore, in cooperation with client stakeholder, robust Procedures for KYC Process and Transaction Monitoring were created. In course of the project, Training curriculum, including training plan and training materials were also created.

In addition to that, PwC delivered a list of observation and proposed recommendations. In addition, PwC prepared a list of observations and proposed recommendations aimed at improvement of the AML/CTF processes, as well as supported the implementation of KYC Periodic Review process.

Context

A European PSP requested support in preparation of KYC Working Instructions, training sessions delivery for new hires, as well as operation support, to support the growth of its operational teams.

PwC approach

In course of the project, PwC assisted in defining the needs of the client’s operational teams, in the context of designing KYC Working Instructions, training new hires, as well as the knowledge management process.

In close collaboration with client’s Compliance, Operations and Process Architects, we created a design of the Knowledge Management infrastructure and Induction plan for new hires (tested on the two groups). Additionally, operational support during the KYC Periodic Review process supported PSP’s efforts to reduce the backlog in this area.

Context

A European PSP, as a part of its efforts to remediate its AML/CTF and Risk Management Program requested support in preparation of KYC Procedures, Enterprise Wide Risk Management, as well as operational support.

PwC approach

During the project, PwC in close collaboration with the client’s stakeholders worked on the improvement of number of components of the AML/CTF and Risk Management Programs. New, robust KYC Procedure was created to support PSP’s efforts to remediate its Merchant portfolio and improve the level of compliance with laws and regulations. Moreover, PwC engaged with a broad group of stakeholders, including Compliance, Product Owners, Sales, Finance, Credit risk and IT, to deliver structured approach to Risk Management - creating detailed Risk Taxonomy, assessing Risk Profile of the organization, as well as creating fit for purpose Risk Appetite Statement. In addition to that, operation teams supported client’s plans to perform KYC remediation on its Merchant base.

Key benefits

© 2015 - 2025 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.