Nature of evaluation

MONEYVAL is the main monitoring body of the Council of Europe, tasked with supervising compliance with principal international standards of AML/CFT and advising national authorities on necessary improvements in this area.

MONEYVAL carried out the evaluation on-site visit to Poland from 10 to 21 May 2021. The Fifth Round Mutual Evaluation Report adopted at the 62nd Plenary Meeting in Strasbourg on 16 December 2021 was published on 1 February 2022.

The main focus of the evaluation was to assess if the Polish AML/CFT system:

is effective in preventing money laundering and terrorist financing;

is compliant with FATF’s 40 Recommendations;

can be strengthened.

Key Observations

- Polish AML/CFT system strengths

- Improvement of regulatory framework

- Understanding of ML and TF vulnerabilities

- Handling of terrorism financing (TF)

- Proliferation financing and targeted financial sanctions (PF-TFS) framework

- Supervision of virtual assets service providers (VASP)

- Payment service providers (PSP) sector assessment

- Non profit organizations

- Confiscation of proceeds of crime from ML/TF

Polish AML/CFT system strengths

Good understanding of risks and implementation of mitigating measures in the banking sector.

Level of effectiveness demonstrated by the public sector entities in applying the ML and TF preventive measures, including customer due diligence and internal controls.

International cooperation and information exchange for AML/CFT purposes.

Improvement of regulatory framework

Expanded domestic cooperation framework should be introduced, so all supervisory authorities maintain efficient and risk-based supervision.

Additional mechanisms for cooperation and coordination of issues related to AML/CFT should be introduced by expanding the role of existing national platforms.

Cash control mechanisms at the border should be strengthened through the provision of a legal basis to stop, restrain or seize suspicious assets.

Additional controls and supervisory frameworks should be developed for financial institutions, virtual asset service providers (VASP’s) and designated non-financial businesses and professions to prevent the criminal control of obliged entities.

A more intensive approach should be developed to ensure consistency across the departments dealing with licensing and market entry to prevent criminals from controlling financial institutions.

Understanding of ML and TF vulnerabilities

Although the National AML/CFT Strategy was adopted by Poland on 19 April 2021, the overall understanding of ML and TF vulnerabilities should be strengthened.

A systemic approach should be developed and consistent action taken to align objectives and activities of competent authorities with national AML/CFT policies.

The private sector should be provided with guidance on the implementation of the recommendations of the National Risk Assessment (NRA).

The Financial Security Committee (FSC), Poland’s AML/CFT advisory and consultative body as per the Polish AML/CFT Act, should coordinate the risk-based activities of relevant authorities in order to ensure the reliability and adequacy of beneficial ownership information held in Poland.

Handling of terrorism financing (TF)

Authorities should take actions to ensure that terrorism financing is treated as a stand-alone crime and not as a byproduct of terrorism.

Investigation of TF cases should be supported by additional guidelines and instructions.

Financial investigations should be carried out not only in terrorism-related cases but also in cases of suspicions about the legality or destination of funds.

Training and awareness-raising initiatives should be developed for authorities, in order for them to all acquire sufficient knowledge to start and conduct a TF case on their own initiative.

Proliferation financing and targeted financial sanctions (PF-TFS) framework

Proliferation refers to spreading of weapons of mass destruction and sharing the technology or means for it’s production.

Supervisory system and sanctioning regime on PF-TFS must be urgently put in place.

Supervisory authorities must develop responsibilities and a legal framework for monitoring compliance with PF-TFS regimes.

Private sector entities should be supported with specialized training on PF-TFS.

Supervision of virtual assets service providers (VASP)

Registration or licensing regime for VASP’s should be created. Additionally, a legal framework which imposes penalties on such entities must be developed.

Harmonised approach for ML/TF risk assessments for virtual asset service providers (VASP) should be created.

Proper regulatory guidelines and frameworks should be established for common treatment of ML/TF risk connected to VASP’s.

Payment service providers (PSP) sector assessment

It was noted that PSPs often check external sources when performing CDD to ascertain the payment, customer profile and its business activity.

In terms of source of funds, however, it was noted that PSPs that mostly serve Polish merchants (payees), rely on banks for its verification.

It was assessed that PSPs implement similar real-time and ex-post controls to those of banks for wire transfers when processing payments;

It was observed that PSPs have implemented effective control measures and verification steps to

ascertain the identity of the customer,

avoid any potential risks associated with online customer onboarding and identification processes.

Predominantly, risk seems to reside in smaller, less regulated and harder to identify PSPs, who offer more complex and sophisticated services, which was observed to hinder the traceability of transactions.

Non profit organizations

Non Profit Organizations (NPO) exposure to TF should be covered and communicated clearly to all relevant authorities and obliged entities, so there is a common understanding of risks connected.

In order to improve the NPO sector’s understanding of their exposure to TF risks the following must be developed:

dedicated NPO sector risk assessment and guidelines,

targeted risk-based approach to the supervision of the NPO sector

Confiscation of proceeds of crime from ML/TF

Confiscation of proceeds of crime from ML/TF should be more decisively pursued as a policy objective by Law Enforcement Agencies (LEA’s). Moreover, confiscation actions need to be consistent with ML/TF risks and national AML/CFT policies.

Consistent practice and expertise should be developed to enhance asset tracing.

Authorities should ensure that relevant statistics on seized, confiscated and returned assets are gathered and maintained.

Authorities should establish a coherent system for the handling and management of secured assets as well as the enforcement of confiscation orders.

The LEA’s should continue to expand and reinforce their operational asset tracing and asset recovery capacities through specialised training, technological solutions or expanded resources.

Conclusions and possible impact

Outcome

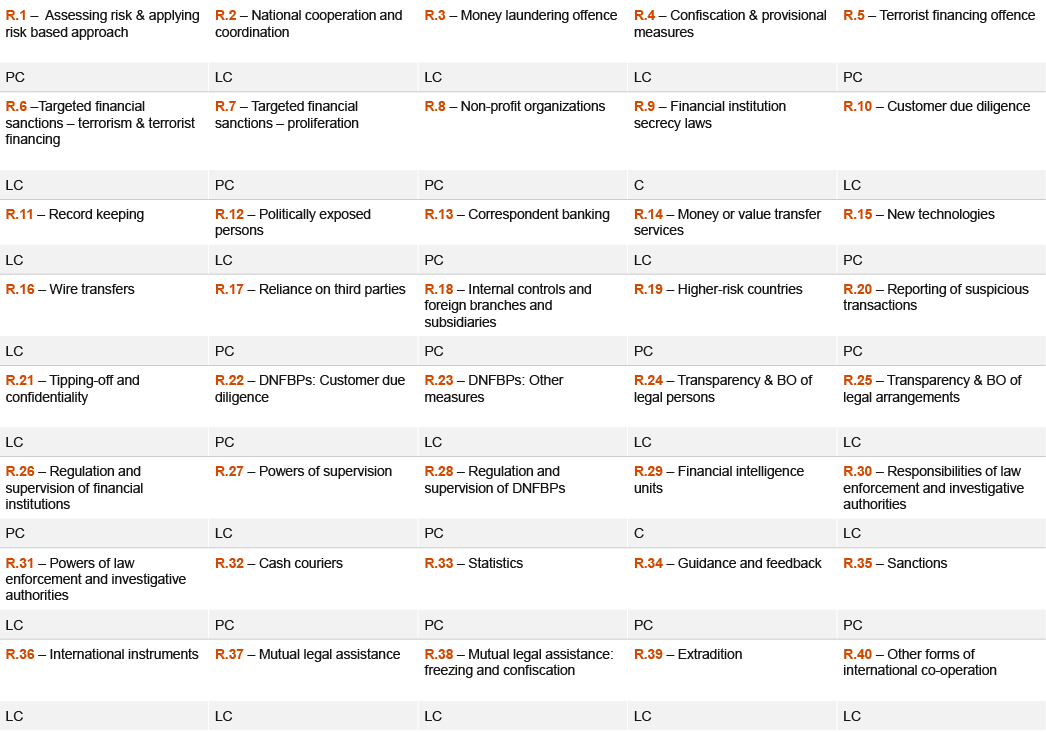

According to the report, the Polish AML/CFT system was fully compliant with 2 FATF Recommendations, largely compliant with 21 and partially compliant with 17 out of 40 Recommendations.

The follow up process will require a submission of a progress report and describing the new measures and actions taken since publication of the mutual evaluation report.

The compliance with each of the 40 Recommendations has been evaluated as: Compliant (“C”), Largely Compliant (“LC”), Partially Compliant (“PC”) or Non-Compliant (“NC”).

Follow-up process

As a result, Poland will be put under MONEYVAL's enhanced follow-up reporting process, due to identified deficiencies1.

Additional steps might include official disciplining letters or high-level visits of MONEYVAL and European officials.

As a last resort, MONEYVAL may issue a statement of the country's insufficient compliance with AML standards and advise all AML/CFT network members to address the risk posed by a non-compliant state or jurisdiction.

Possible consequences

Being designated as a target of an enhanced follow-up means that, according to MONEYVAL, unsatisfactory compliance with AML standards or more decisive actions need to be performed in the evaluated jurisdiction2.

By taking appropriate and timely actions in the areas that require improvements, Poland can avoid being designated as a non-compliant jurisdiction.

Contact us