{{item.title}}

{{item.text}}

{{item.text}}

The term Great Resignation has become popular over the last 2-3 years, as many people felt discouraged and resigned from their work. In our research, we don’t see such a phenomenon among Finance professionals in CEE.

But what we do observe is a trend that might be called a Great Reshuffle. People change their job very often, perceive the ease of changing jobs as very high and demand substantial salary increases. 53% of Finance professionals consider changing their work within a year.

Undoubtedly, building a sufficient and effective financial team is currently a challenge for a CFO. Employers need to equip their finance teams with the skills necessary to thrive in a rapidly changing business environment. If they do not, they run the risk of losing their best people, who are their most important asset. We hope that the results of the research will allow us to better understand the ambitions and expectations of the team.

“Today business knows that transformation brings profitability. Out of the survey participants, GBS organisations have gone through the highest number of large transformations (89% vs. an average of 71%). In fact, very often GBS centres become key leaders and enablers of such changes to deliver the value to the business. This again provides great upskilling opportunities to employees. In addition, it allows the elimination of basic tasks through process improvement and automation. This way finance professionals can focus on more meaningful work where their knowledge can be utilised better.”

Aleksandra Stelmach-Gryszka

Director PwC Poland

Organizational Transformation

53% of respondents plan to or are considering leaving their jobs. Of those polled, 63% cited career advancement opportunities. In fact, 33% said their work lacked any purpose. For younger professionals 35 and younger, 78% revealed they would change roles for a greater salary. However, research shows those 35 and over are driven more by their corporate standing and responsibilities than their existing financial remuneration packages.

Over half of finance proffesionals may consider chainging their job shortly:

“Companies need to develop and maintain a stable team of highly skilled experts with strategic capabilities and engage them in a meaningful way to transform the organisation. Yet, the battle for talent is getting tougher. Companies no longer compete only with each other in similar fields. Technology is ubiquitous and essential in nearly every branch of business. Young talents want to be independent and carry out their own projects. It is high time to prepare solutions to meet their expectations by creating intrapreneurship, tech-hubs or bootcamps that foster employee-led innovation.”

Michał Grzybowski

Partner PwC Poland

CEE People and Organisations Leader

Burnout among young professionals 35 and younger was the lowest of the three age categories polled (36%). For 35 to 44-year-olds and those older than 44, it was 42% and 40% respectively. Team leaders suffered in this regard, with 51% reporting burnout. More than one-third of specialists (35%) expressed the same concerns, a likely knock-on effect from current recruitment and retention challenges.

Burnout is becoming a serious challange:

The solution to burnout lies in adopting a working model that supports staff at all levels. Those working in the hybrid model were less likely to report burnout than colleagues who returned to full-time, office-based work. Many specialists, who tend to devote significant time to individual projects, particularly enjoyed working remotely. Team leaders do not want to return to the office either.

Elastic model of working prevents people from quitting their job:

Finance competencies remain important skill sets. Yet the Great Reshuffle has also given employees time to assess what skills matter most to their careers. Interestingly, 83% believe the ability to attain new skills quickly is an essential competency in today’s profession.

Which skills and competances will increase in importance in the coming years?

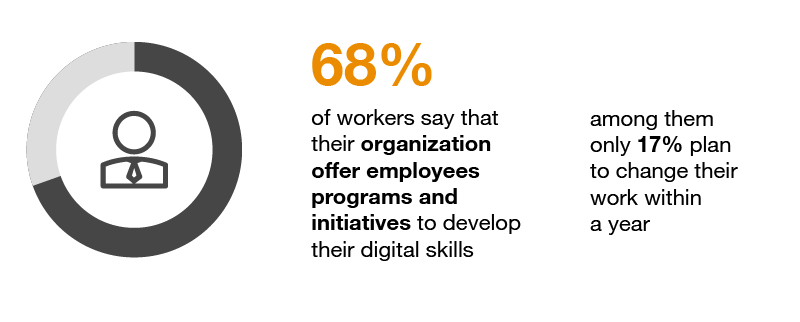

Of the 68% who said that upskilling programs exist in their company, only 17% wanted to leave their roles. A clear correlation exists between upskilling opportunities and employee retention. The same opportunities should be applied to middle- and upper-management employees. Our research found that 75% valued upskilling, fairnessand transparency in their leaders.

Upskilling initiatives apparently increase workers satisfaction with their curret job:

Great Reshuffle is a fact and there are a number of examples how it demonstrates across the Finance community. However there are different ways and opportunities to address it and decrease its impact:

Organizations are the people in them… it is people who make the place and it is only thanks to their skills, engagement and attitude that we can go through difficult moments.

The report’s findings clearly show the modern-day accounting and finance professional. Employees now expect career progression opportunities and transparent care from their employers.Without these benefits, a high salary may no longer be enough for more experienced and skilled staff — particularly if they have to return to the office full time.

About the survey

The online survey was conducted among 270 Finance professionals between August and November 2022. The respondents came from CEE countries – Poland, Czech Republic, Slovakia, Hungary, Bulgaria, Austria and Romania. Respondents came mainly from large companies (>500 mln euro in turnover), from various sectors: Business Services, Technologies, Finance, Manufacturing, Consumer Goods, Pharma & Healthcare. They mainly work in Controlling, Reporting, FP&A departments and Accounting.

{{item.text}}

{{item.text}}