Learn the requirements and adjust in time to the mandatory e-invoicing

E-invoice and the National System of e-Invoices (KSeF)

Taxpayers can voluntarily use KSeF from January 1, 2022. The e-invoicing obligation was to enter into force on July 1, 2024, and for small and medium-sized enterprises exempt from VAT from January 1, 2025. On April 26, 2024, the Ministry of Finance announced that the new rules will be effective from:1 February 2026 - for taxpayers whose turnover exceeded 200 M PLN in a preceding year, 1 April 2026 - for other taxpayers.

About structured invoices

Why is it worth starting preparations for the implementation of the mandatory invoicing system now?

Structured invoices are one of acceptable forms of documenting transactions, in addition to the paper invoices and so far used electronic invoices. Structured invoices are issued and received via the ICT system of the Ministry of Finance - the National System of e-Invoices (abbreviated as KSeF).

Check how we can help your organization

The main challenges for the taxpayer

Data

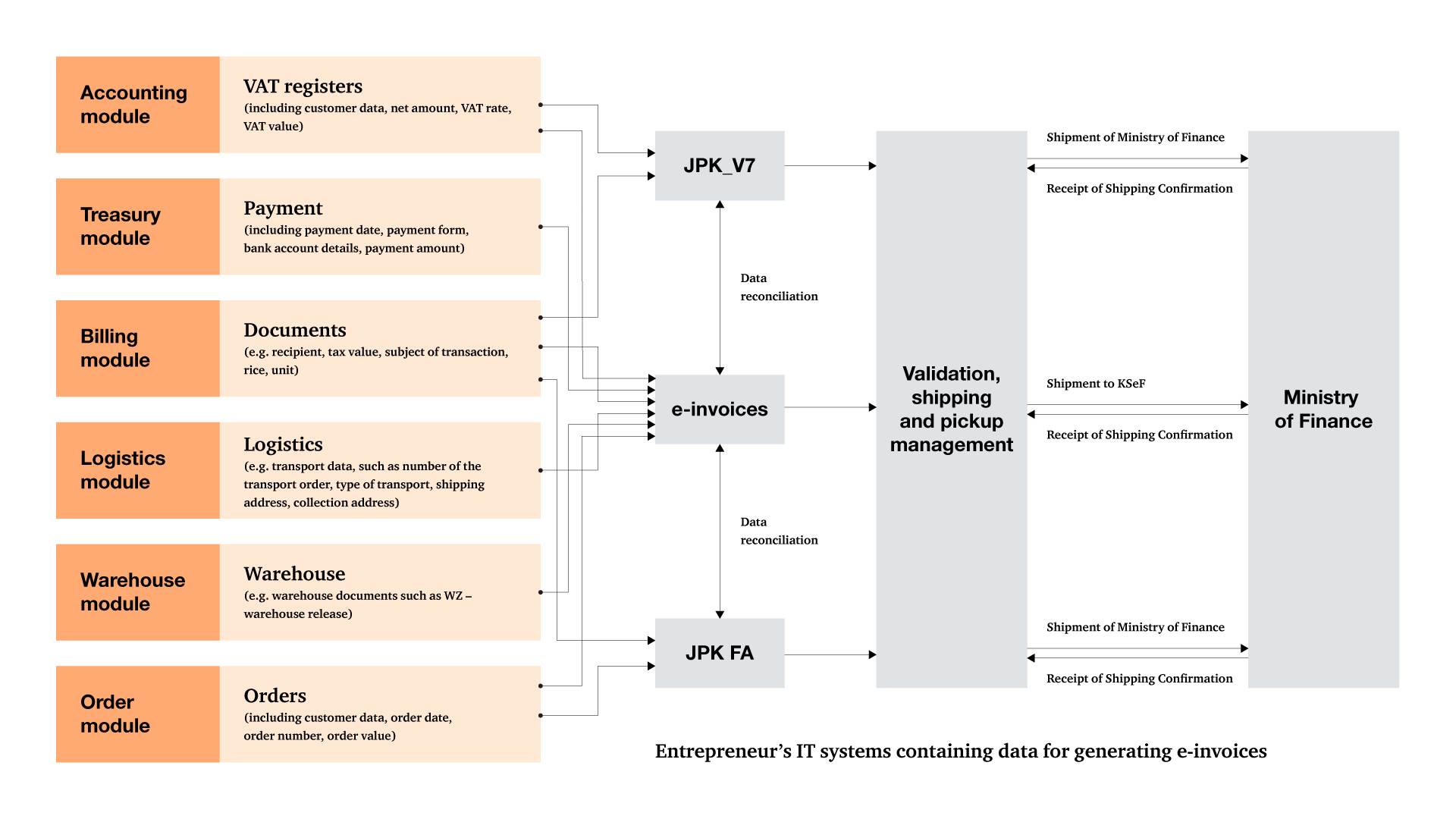

The necessity to request for an invoice in a structured form requires collecting a wide catalog of data expected by the tax authorities. This data may be scattered among systems or simply unavailable.

Process

Due to the necessity to issue an invoice via KSeF and the risk of exposing possible irregularities, the processes in the organization must be adapted to the fact that invoicing is as structured and automated as possible.

Technology

Requests are issued and received in structured form - aggregation, processing and transferring data require technical preparation from the client as well as reconstruction and integration of already existing systems.

Find out about the main assumptions of the KSeF

- From January 1st, 2022 there is a possibility of issuing structured invoices which are in line with the technical guidelines of the Ministry;

- The scope of data reported under the new form of invoice includes many additional elements, other than the standard invoice;

- The KSeF is to structure and provide the real-time control over the invoicing process;

- Taxpayers can voluntarily use KSeF from January 1, 2022. The e-invoicing obligation was to enter into force on July 1, 2024, and for small and medium-sized enterprises exempt from VAT from January 1, 2025. On April 26, 2024, the Ministry of Finance announced that the new rules will be effective from:1 February 2026 - for taxpayers whose turnover exceeded 200 M PLN in a preceding year, 1 April 2026 - for other taxpayers.

At the beginning of October 2021, the Ministry of Finance published an announcement about the start of KSeF tests. The provided documentation is strictly technical and is intended for IT departments working on integration with the KSeF. Starting from 1 January 2022, you can issue your invoices electronically in the National System of e-Invoices using the production environment of the National System of e-Invoices.

The topic of e-invoices affects many aspects related to activities of companies, both financial and accounting, legal and technical. The new regulations are a real challenge in the area of technology, processes and organization. Therefore, it is worth preparing for the introduction of e-invoices in advance instead of leaving this issue for the last minute. A comprehensive approach to the new requirements will protect entrepreneurs from possible consequences of an incorrect approach to these challenges.

How will the data flow for generating e-invoice in the enterprise work?

We will support your organization in the challenges related to revolutionary change

We offer a professional tools and comprehensive support, which will support your company, so as to prepare for new duties on time. How can we help?

- Taxolite e-Invoicing Tool

A dedicated KSeF e-invoicing tool allows for full and flexible adaptation to the upcoming changes in invoice issuance without the need to adjust ERP or billing systems. It is also unnecessary to change the key integration processes of systems that are already implemented and functioning in the company.

- Statutory Compliance Suite: e-Invoicing PL KSeF

A comprehensive solution that supports the issuance and receiving of e-invoices with KSeF in real time. The processes of e-invoice handling are fully automated.They integrate non-invasively with standard SAP processes, with a view to minimize user involvement. The application is available in Polish and English.

- SAP Document Reporting Compliance DRC for KSeF

Are you ready to send your invoices to KSeF? What data is needed to generate a correct e-invoice? How can you process e-invoice data from a supplier in the accounting system? Would you like to see your invoices from today in the KSeF e-schema? We offer the opportunity to analyze historical documents using a questionnaire or through the SAP module - KSeF Readiness Check.

- KSeF Data Tester

Do you want to check if your e-invoice will be accepted by KSeF? The tester will verify if your file complies with the e-invoice schema. Additionally, a set of business tests developed by the PwC team of experts will check the data for its substantive content.

Our services

Process and Tax Support

PwC's support will primarily involve verifying and mapping the currently functioning processes related to issuing and receiving invoices. The conducted analysis will also highlight tax risks associated with the current invoicing model.

The main focus of this analysis will be to examine whether the processes operating within your organization enable the implementation of a reliable structured invoicing system and then optimize these processes.

This will not only facilitate the implementation of KSeF but also allow for significant cost reductions by decreasing the amount of manual labor required today — through the automation of processes previously carried out manually (at least partly) by employees.

Based on the results of this analysis, PwC will create an implementation map for structured invoices within your organization, along with identifying processes that will enable the issuance and receipt of structured invoices in real-time in a standardized manner.

The proposed invoicing model will also include comments on managing identified tax risks. Ultimately, we will also assist your organization during the implementation phase of structured invoices.

System and Technology Support

Our service encompasses a comprehensive system analysis of reporting requirements in structured invoices, taking into account the specific nature of each entity's activities, including the substantive, logical, and technical correctness of the schema. We also offer support in preparing the target model for data and information flow processed in the client's systems and within integration with KSeF.

We assist clients in implementing, building, and testing their own technical solutions and in redesigning systems in both business and technical requirement areas. We also provide support through the implementation of PwC solutions.

Legal Support

Legal advisory services encompass the comprehensive and secure implementation of the e-invoicing system for clients, particularly in the context of legal and regulatory obligations.

Legal support includes:

- Advice on the impact of e-invoicing implementation on existing procedures and contractual relationships, including agreements on payment terms, methods of delivery, invoice corrections, and granting discounts on receivables covered by e-invoices,

- Analysis of accepted e-invoicing solutions in the context of the obligation to report payment bottlenecks,

- Proposals for adapting contractual clauses and internal procedures concerning new e-invoicing regulations, as well as the parallel functioning of "regular" invoices,

- Preparation of internal documentation, especially employee-related, for using the National e-Invoicing System and protecting the employer's interests,

- Advice on adapting implemented e-invoicing solutions for potential audits and proceedings conducted by the President of UOKiK regarding excessive delays in commercial transactions.

Support within PMO

We believe that the Project Management Office (PMO) should play one of the key roles in the implementation of e-invoicing. The significance of PMO is high due to the complexity of the subject. Competing in unstable markets, keeping up with rapid technological innovations, and meeting constantly changing consumer expectations—all require a new form of business agility, which PMO strives to achieve.

PMO support covers not only the effective coordination of activities related to e-invoicing implementation, such as building a data catalog, adapting business processes, and preparing and monitoring technical changes (including redesigning and integrating existing systems). Within PMO and change management, we will implement processes that provide proper oversight, allowing for the creation of an appropriate knowledge base and efficient information flow during implementation. All of this ensures that people stay focused on what is important, understand their task responsibilities, and that risks associated with the implementation are monitored and actively managed.

Managed Services

PwC can provide comprehensive support for organizations that have internally implemented system solutions related to KSeF, as well as for organizations seeking "process outsourcing." This offering will be particularly appealing to entities with a small number of purchase and sales documents where the client does not have an ERP system integrated with KSeF.

Within the offered scope, we propose:

- Recording and preliminary classification of purchase invoices;

- Real-time submission of sales invoices to KSeF;

- Process management and cyclical reporting;

- Optimization of the invoicing process;

- Verifying the correctness of GTU and MPP tagging;

- Ongoing monitoring of the impact of legal changes and court rulings on invoicing accuracy;

- Verification of transaction classification accuracy based on logistical data contained in e-invoices;

- Support in interactions with tax authorities in case of inquiries;

- Clarification of doubts regarding transactions.

E-invoice and the National System of e-Invoices (KSeF)

Contact us