Too many false positive alerts - those that are not posing AML risks, is one of the top concerns of the financial institutions worldwide.

The questions are:

How to identify them seamlessly and precisely?

How to reduce false positives and minimize the risk of missing a true hit?

80% - 90% of Transaction Monitoring and Name Screening hits are false positives

How can AI help in Transaction Monitoring?

In ever changing business environment, growing complexity of banking products and their usage ways of identifying true risk and focusing on it while keeping diligence and compliance are key. Artificial Intelligence is a way to achieve that in the bank of the future.

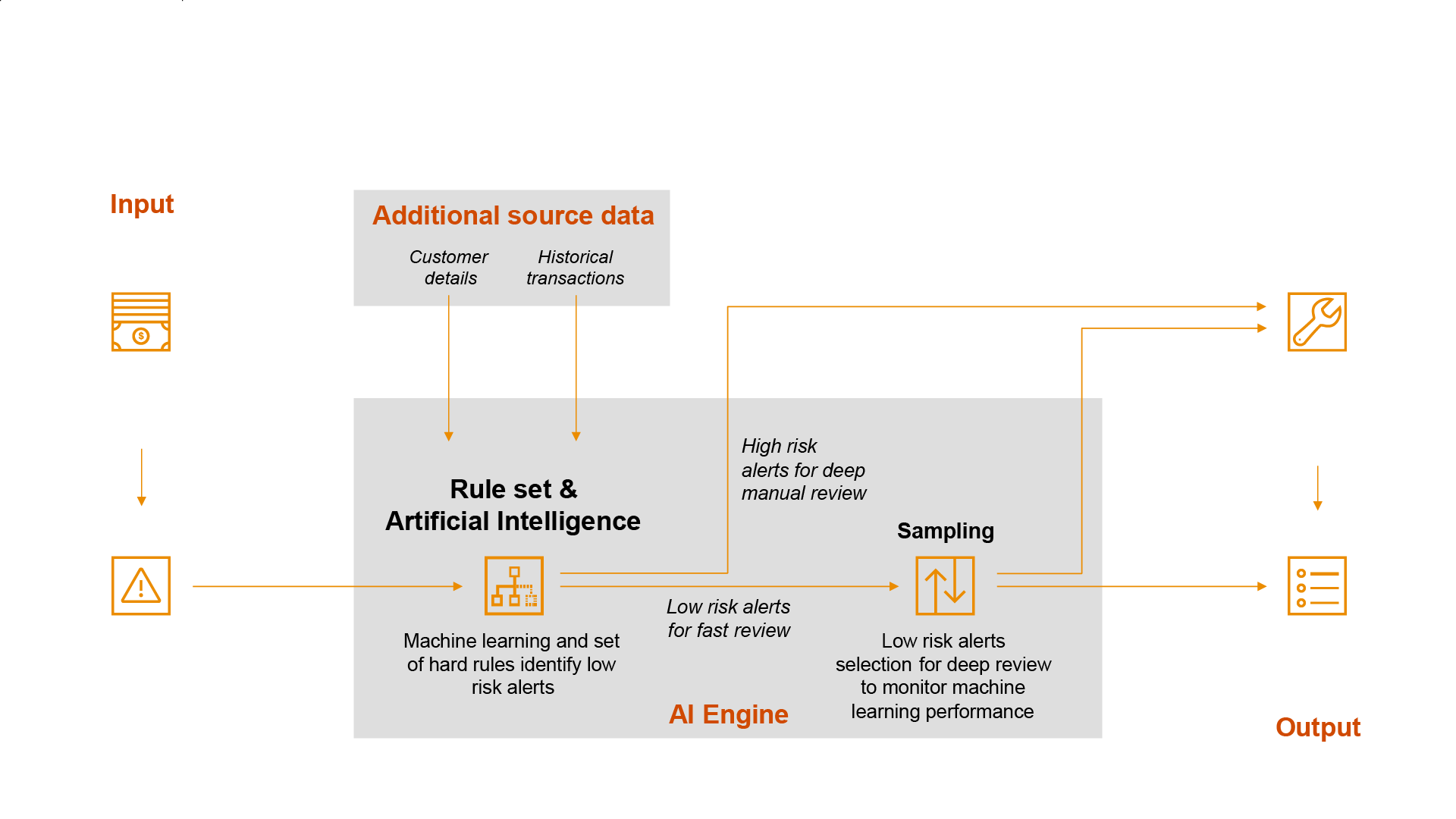

For all alerts generated by the Transaction Monitoring system of the financial institution – AI can identify the ones that are not posing the transactional risk of money laundering and terrorist financing.

Method is based on multiple sources of information about the customer, their transactions, customer profile and historical transactional activity. A set of hard rules, machine learning algorithms and artificial intelligence engine allow to identify the Transaction Monitoring alerts with minimal risk of being actual suspicious transactions.

A portion of the alerts can be analyzed much faster as it poses minimal risk of containing actual suspicious transactions and does not require deep manual review. Once identified, such alerts can be documented and analyzed with minimal analyst effort while the operational team can focus on those that might really pose a potential transactional risk, allowing more space to thoroughly investigate them.

How Artificial Intelligence identifies low risk transactions?

Our end-to-end methodology and AI model follow your risk based approach and risk management standards, while minimizing human effort and maintaining high process efficiency.

Our track record shows that for 25% to 75% of all alerts a manual investigation can be limited or even avoided.

Contact us