How to build a modern financial department, ready for the main challenges of the new reality

Investigating the maturity of financial functions among CFOs of companies in Poland

Finance function's strategy, focused on reporting financial data, mainly historical, whose value devalues over time, is inadequate in today's reality.

The digital revolution is changing the way organisations operate and the way they respond to the increasingly demanding needs of their stakeholders. Yet, the results of our survey indicated that in Poland only 14% of companies have a mature financial function. However, the developed maturity index indicates that even the best ones have a gap to make up in certain categories.

Only under the leadership of the right leader and in a modern organisational structure based,

among other things, on the pillar of Business Partnerships, does the finance department have

the opportunity to make a transformation.

Discover the key findings of the study, a profile of the mature finance function and a proposal for

action to join the ranks of finance leaders ready for the challenges of the new reality.

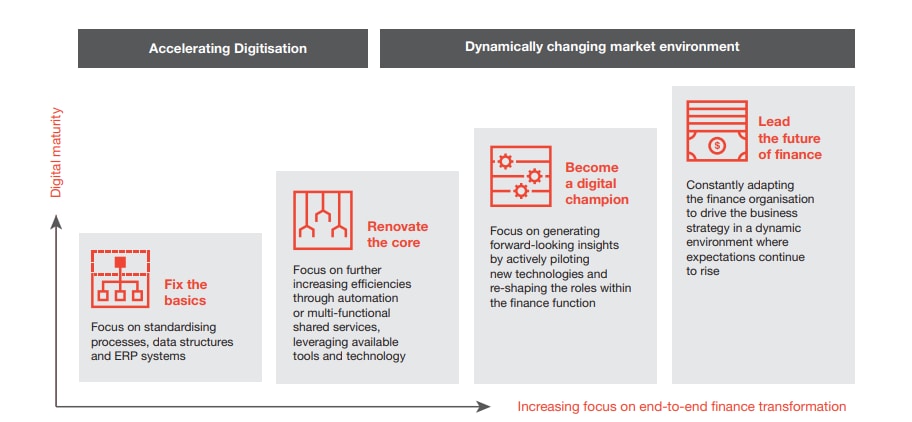

The way to transform finance

Fundamental transformation of the finance function

Phases of development of the finance function - from a department focused on providing historical financial data to a true business partner supporting the implementation of the business strategy in a dynamic environment, in response to the growing expectations of the organisation.

Business Partnering

In today's technology and data age, CEOs are looking for real-time information to help them make better decisions. In order to make them, they need to have precise information about the drivers of the business (both internal and external). It is therefore imperative that finance knows the links between key business drivers and understands their impact on the vision and business strategy set by the CEO. This leads to better quality management information, which in turn enables the finance team to better tell the story of the organisation's strategic performance. Simply knowing the numbers is not enough. You need a bigger picture knowledge and understanding of how the different functions of the organisation work together to ensure the successful implementation of strategy.

You need a bigger picture knowledge and understanding of how the different functions of the organisation work together to ensure the successful implementation of strategy.

Tailor-made cooperation between Finance and Business will be characterized by:

- a dedicated team in the area of controlling for the given process;

- ongoing and flexible reporting and analysis for the implementation of value and efficiency building initiatives;

- ongoing communication of conclusions based on forecasts and multidimensional scenario analyses;

- support for operational and strategic processes requiring analysis-based decision-making, e.g. pricing policy, procurement processes, efficiency initiatives, contract reviews.

Scenarios for forecasts and plans

Reporting on operational KPIs

Signalling risks and opportunities

Evaluation of investment projects

Evaluation of business process efficiency

“Without digital tools to automate mundane tasks, finance teams remain burdened with transaction processing, manual controls, and compliance. The challenge for finance is to move beyond just collecting and processing data, and to start actually using it. Machines and automation can collect and process data much more effectively and much more efficiently than humans. We have much to offer the business that machines cannot, therefore the focus of our efforts should be to ensure the integrity of our data and to use it in new and different ways. 98% of finance leaders look for experience of new technologies and finance process automation when recruiting. If finance professionals are to remain relevant in the digital world, they must change their traditional, number-focused, skillset. This is noticed by over 80% of respondents who are already planning employee training today to minimize the gap between the digital skills of the financial function and the company's digital ambitions. In this competitive world, finance skills alone are no longer enough."

How to start Finance transformation?

Processes

What do financial processes look like and what should they look like?

Processes and planning still take too long.

The results of the report indicate that the month-end closing process, which takes more than 10 days, is still a challenge for almost 1/3 of CFOs. It is worth analysing the reasons for this situation and consider, for example, reviewing the process of creating provisions and accruals.

Additionally, a challenge for one in five CFOs is the reconciliation of statutory and management data done manually in spreadsheets . It is virtually impossible to align management reporting with the needs of the business if the finance function is still mostly spending time on manual adjustments and spreadsheet-based analysis activities.

When it comes to the annual planning process, it takes between 31 and 120 days among the majority of organisations surveyed. Only among a small group (16%) is it less than 30 days. This is mainly due to the overall level of financial maturity of the companies surveyed and the challenges faced by CFOs, for example in reducing the time required to close the month. With a properly designed process and the support of IT tools, this process should not take more than 4 weeks according to market best practices.

How long does the annual planning process take?

Technology

To what extent are cloud solutions being used?

Low level of sophistication in the use of cloud services.

As the results of our survey indicate, 24% of CFOs are not yet using cloud solutions at all. Still in the minority (37%) are those who use cloud software on a service (SaaS) basis. The majority (67%) use the cloud as an infrastructure for storage and file sharing.

However, it is important to note that cloud solutions are currently growing in popularity as they

are also becoming more accessible and are setting the stage for modern IT solutions for

finance. Most technology providers already offer their latest tools in the cloud or plan to migrate

in the near future and not maintain support for previous versions of systems.

To what extent are your subordinate areas using cloud solutions?

People

What does it look like to prepare finance teams to use advanced technologies to automate processes?

Transformation of the work model.

On the one hand, a clear trend of centralisation, outsourcing and automation of simple and

repetitive tasks can already be noted for several years. On the other hand, the business world is

becoming increasingly complex, full of interdependencies and connections.

Changing roles and perceptions of employees entail the need to remodel competencies. Only 20% of respondents

indicated that finance employees are familiar with and use the full or

advanced functionality of new process automation technologies.

Interestingly, 81% of CFOs plan to fill the competency gap with development programs or training of current employees, and 21% with goals established under current incentive systems, i.e. actions that are available and achievable, but require appropriate actions or internal projects

within the organization.

When recruiting new employees, do you take into account criteria related to knowledge of new technologies and experience in automating financial processes?

About the survey

The CFO Compass Survey was conducted in Q2 and Q3 2021 among more than 50 CFOs of companies with an average turnover of PLN 1.6 billion and employing an average of 1,500 people, operating in Poland in over 10 sectors, including: retail (20%), manufacturing (15%), food industry (9%), technology (9%), real estate (8%), professional services (8%) and others.

Program PwC CFO Compass

CFO Compass is a platform that brings together a knowledge base, experts and a wide range of support dedicated to CFOs. We work with nearly 1,000 CFOs of large and medium-sized enterprises across all industries, helping them digitally transform their organisations to optimise back-office processes and improve cost efficiency while maintaining compliance and a skilful approach to risk management. For more information, visit www.pwc.pl.

CFO Compass Survey 2021 report

Download the full report

Stay updated

Subscribe to PwC email updates

Contact us