{{item.title}}

{{item.text}}

{{item.text}}

W handlu w ciągu ostatnich dwóch lat oczywistością stał się fakt dynamicznego wzrostu sprzedaży w kanale cyfrowym. Przymusowa izolacja oraz ograniczona możliwość zakupów w fizycznych sklepach często pozostawiały zakupy online jako jedyną drogę zaspokojenia potrzeb konsumenckich. Wśród kanałów cyfrowych zdecydowanie najpopularniejsze są platformy zakupowe (marketplace), które w 2021 roku na świecie odpowiadały za ponad 40% wszystkich wydatków w kanale cyfrowym.

Platformy zakupowe w wielu krajach wysokorozwiniętych były również wiodącym źródłem inspiracji dla konsumentów. W USA 57% konsumentów wskazała Amazon jako główne źródło inspiracji, podczas gdy w Niemczech było to 56%, a z kolei w Wielkiej Brytanii 52%. Natomiast wiodące platformy zakupowe w takich krajach jak Tajlandia czy Indonezja stanowiły podstawowe źródło inspiracji dla odpowiednio 70% oraz 76% konsumentów.

Pomimo już znacznego udziału w handlu cyfrowym popularność platform zakupowych nieustannie rośnie. W latach 2020 oraz 2021 sprzedaż poprzez platformy zakupowe na świecie wzrosła ponad dwukrotnie (skumulowany roczny wskaźnik wzrostu 2019-2021 wynosił blisko 50%). Tempo wzrostu platform zakupowych było ponad dwukrotnie wyższe niż sklepów e-commerce, które w tym samym czasie rosły średnio 22% rocznie3.

Dynamiczny wzrost platform zakupowych wynikał zarówno ze wzrostu liczby sprzedawców (podwojenie liczby sprzedawców w roku 2021 w porównaniu do roku 2019), jak i zakresu asortymentu, który na przestrzeni ostatnich dwóch lat wzrósł o 62%. Wzrosty te przełożyły się na znaczący wzrost konsumentów kupujących praktycznie wyłącznie na platformach zakupowych (42% konsumentów deklarowało dokonywanie zakupów wyłącznie bądź w zdecydowanej większości na platformach zakupowych w roku 2019 w porównaniu z 57% podobnych deklaracji w roku 2021).

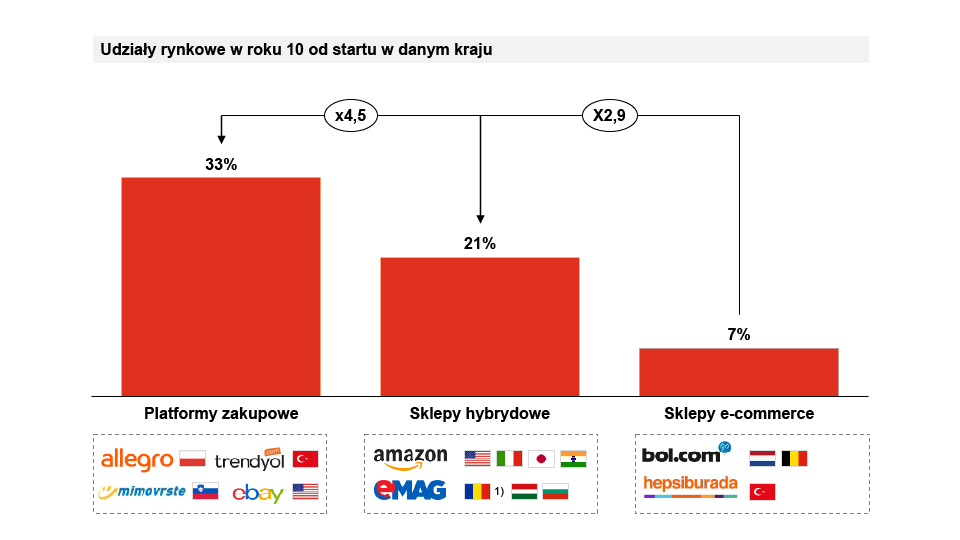

Szybki wzrost platform zakupowych nie jest jedynie wynikiem pandemii, co stanowi dobry prognostyk na przyszłość dla wzrostu tego kanału sprzedaży. W oparciu o udziały rynkowe, jakie w swoich kategoriach uzyskiwali wiodący gracze operujący w modelu 3P (model platformowy), modelu hybrydowym (3P + 1P) oraz 1P (wyłącznie własny asortyment w kanale cyfrowym) w ciągu pierwszych 10 lat od startu na danym rynku przedsiębiorstwa platformowe zyskiwały średnio 4,5 razy większe udziały rynkowe niż sklepy czysto e-commercowe. Również znacznie szybciej rosły przedsiębiorstwa operujące w modelu hybrydowym, w którym średnio osiągały rozmiar bliski trzykrotności swoich konkurentów operujących w modelu wyłącznie sklepu 1P.

Powyższe dane wskazują na wyraźną przewagę platform zakupowych nad przedsiębiorstwami nastawionymi na asortyment własny (model 1P). Możliwość skalowania i elastyczność podaży uzyskana dzięki ekosystemowi sprzedawców zewnętrznych pozwala na zaoferowanie klientom końcowym znacznie szerszego asortymentu, a kilka ofert tego samego produktu daje poczucie dokonania porównania cen, a tym samym przekonania o wyborze najlepszej możliwej dla siebie oferty.

W Polsce, podobnie jak na zachodzie, udział platform zakupowych szacuje się na przeszło 40% rynku, z czego 36 punktów procentowych przypada na naszą rodzimą platformę Allegro, 3 punkty procentowe na Aliexpress oraz około 2 punktów procentowych na pozostałe platformy takie jak Empik, Zalando, Amazon czy eBuy. W Polsce zakupy na platformach zakupowych deklaruje 2/3 Polaków kupujących online, a blisko 1/3 konsumentów wskazuje ten kanał jako ich ulubione miejsce dokonywania zakupów w kanale cyfrowym. W tego typu serwisach Polacy cenią przede wszystkim szeroką i zróżnicowaną ofertę dostępną w jednym miejscu, a także tanią, bądź darmową dostawę oraz szybkość realizacji zamówienia.

Allegro, nasza rodzima platforma zakupowa, w roku 2021 odnotowała wzrost GMV o 21,3% względem roku poprzedniego, z czego znaczna część tego wzrostu przypadła na pierwsze dwa kwartały, kiedy obostrzenia covidowe były najcięższe. W pierwszym kwartale wzrost GMV Allegro wyniósł 46.1% względem roku poprzedniego. Duża część tego wzrostu spowodowana była licznymi udogodnieniami oraz wsparciem konsumentów w czasie pandemii. Programy pomocnicze obejmowały darmowy dostęp do usługi Allegro SMART! zapewniającej darmowe dostawy, co przełożyło się na wzrost użytkowników tej usługi o 71,5%. Inne udogodnienia obejmowały wydłużenie terminu płatności dla małych firm, brak prowizji dla nowych sprzedawców przez pierwsze 3 miesiące, łatwiejszy dostęp do pożyczki dla sprzedawców oraz wstrzymanie podwyżki opłat.

Ze względu na znaczny udział handlu internetowego w Polsce, który pod względem penetracji w wybranych kategoriach nierzadko przewyższa wartości dla krajów Europy Zachodniej, Polska stała się atrakcyjnym rynkiem dla licznych zagranicznych platform zakupowych. W 2021 roku do Polski zdecydował się wejść Amazon otwierając swój sklep w domenie .pl. Podjęciu decyzji o wejściu do Polski na pewno sprzyja fakt dobrych prognoz przed dalszym rozwojem kanału cyfrowego w Polsce, jak również duża rozpoznawalność Amazona przez Polaków (ponad milion aktywnych konsumentów na polskojęzycznej stronie Amazon.de). Warto mieć również na uwadze, że Amazon jeszcze przed wejściem był największym amerykańskim pracodawcą w Polsce zatrudniając ponad 19000 pracowników oraz posiadając 10 centrów logistycznych, biuro Amazon Web Services i Centrum Rozwoju Technologii Amazon w Gdańsku.

Swój powrót na rynek polski zapowiedział również eBay. Platforma zakupowa pierwszej próby wejścia na Polski rynek dokonała w 2005. Od tego roku platforma istniała na polskim rynku aż do roku 2011, kiedy podjęła decyzję o wycofaniu się z Polski pozostawiając jedynie możliwości korzystania z jego międzynarodowej wersji. Obecnie eBay próbuje na nowo znaleźć dla siebie miejsce na już znacznie bardziej dojrzałym rynku e-commerce w naszym kraju. Tym razem marketplace wierzy w swój sukces, którego źródłem mają być rozwój sprzedaży globalnych produktów oraz umożliwienia sprzedaży produktów Polskich producentów za granicą.

Ze względu na poszukiwanie nowych motorów wzrostu liczne firmy handlowe decydują się na dołożenie do swojego kanału sprzedaży online oferty podmiotów trzecich, tym samym zaczynając operować w modelu hybrydowym. Przykładami globalnych marek, które odniosły sukces mogą być Best Buy Canada, Carrefour, GoSport czy Conrad. I choć każdy z wymienionych przykładów jest inny głównym celem pozostaje wzrost przychodów. Ten z kolei uzyskany jest dzięki: znacznemu poszerzeniu dostępnego asortymentu, podwyższonej sprzedaży wynikającej z niższych cen oferowanych przez stale konkurujących ze sobą sprzedawców oraz wyższej retencji klientów dzięki możliwości znalezienia wszystkich produktów w jednym miejscu. Skuteczne dodanie oferty 3P do już istniejącego kanału sprzedaży nie jest jednak prostym zadaniem. Przedsiębiorstwa chcące się podjąć tego zadania muszą mieć na uwadze, że istnieje wiele różnic pomiędzy sprzedażą w kanale własnym a jako platforma zakupowa. Jedną z fundamentalnych różnic jest grupa docelowa, do której oferowane są własne usługi. Dla operatora sklepu 1P klientem zawsze jest konsument czyli ostatni punkt całego łańcucha, dla operatora platformy 3P klientem staje się również sprzedawca, bo to jego operator musi przyciągnąć do swojej platformy, aby zapewnić sobie większe przychody. Dlatego też, kluczowe w procesie budowy platformy zakupowej jest wykreowanie solidnej propozycji wartości dla sprzedawców, która zawierać będzie szeroki wachlarz funkcjonalności (narzędzia BI, zarządzanie zamówieniami, personalizacja sklepu itp.), jasną i transparentną politykę wynagrodzeń oraz dostęp do promocji w zależności od skuteczności sprzedaży.

Poszerzenie kanałów sprzedażowych poprzez dodanie oferty 3P do już istniejącego sklepu internetowego jest dość skomplikowaną operacją również z technologicznego punktu widzenia. Dzieje się tak, ponieważ rozbudowanie sklepu 1P o dodatkowy moduł 3P wymaga budowy nowych funkcjonalności dla wszystkich 3 zaangażowanych w transakcje stron.

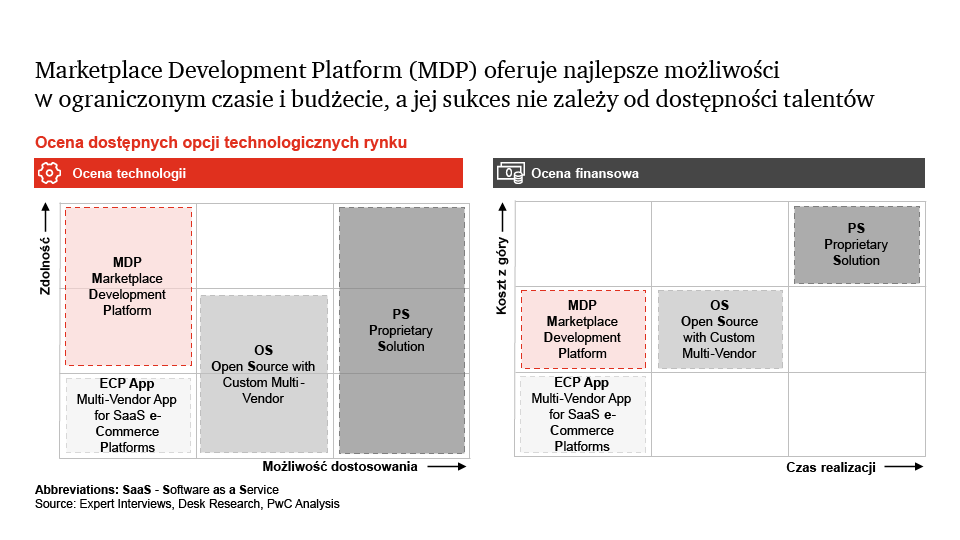

Aby sklep internetowy stał się platformą zakupową, operator musi umożliwić stronom trzecim rozpoczęcie sprzedaży. Aby tego dokonać kluczowe jest uwzględnienie najważniejszych dla sprzedawcy funkcjonalności, takich jak: możliwość wprowadzenia własnego katalogu produktów, możliwość zarządzania listą zamówień oraz ich wysyłką oraz wygodne kanały komunikacyjne z klientem. Wdrożenie wspomnianych funkcjonalności można podzielić na 4 główne sposoby, których wybór zależeć będzie od już używanej technologii, budżetu oraz ambicji operatora platformy zakupowej.

Najprostszym sposobem jest dokupienie wtyczki dedykowanej dla sprzedaży 3P. Ruch ten jednak dostępny jest tylko dla sklepów, które funkcjonują na bazie SaaS-owych rozwiązań tzw. E-commerce Platform. Ponadto, wybranie takiego rozwiązania wiąże się z dość ograniczoną ilością dodatkowych funkcjonalności oraz niską kontrolą nad dostosowaniem platformy, a także wymaga wsparcia zewnętrznego, dlatego też zalecane jest raczej mniejszym dostawcom.

Drugim sposobem jest rozwiązanie open-source, które z kolei dedykowane jest graczom, którzy mają wystarczające zasoby finansowe oraz kompetencyjne, a ich platformy sprzedażowe zbudowane są już na podstawie tego rozwiązania (np. PrestaShop lub WooComerce). Rozwiązanie to daje spore możliwości personalizacji, jednak jest ono w pełni zależne od posiadanych zasobów oraz wymaga dość długiego czasu budowy.

Wymagającym największych nakładów inwestycyjnych, ale i potencjalnie dającym bardzo duży wachlarz funkcjonalności jest zbudowanie od podstaw własnej funkcjonalności zarządzania wieloma merchantami. Jednak skuteczność tego rozwiązania zależna jest od wybranego dostawcy i wymagać będzie długiego czasu budowy.

Ostatnim rozwiązaniem, wybieranym przez bardzo wielu dużych graczy jest tzw. Marketplace Development Platform (np. Mirakl), czyli gotowe rozwiązanie dostarczone przez zewnętrzne firmy skupiające się tylko na budowie funkcjonalności zarządzania wieloma merchantami. Rozwiązania tego typu charakteryzują się pokryciem większości funkcjonalności związanych z segmentem 3P oraz relatywnie krótkim czasem implementacji, a także dość prostym procesem integracji.

{{item.text}}

{{item.text}}